Winco

Photo By Kris Kathmann

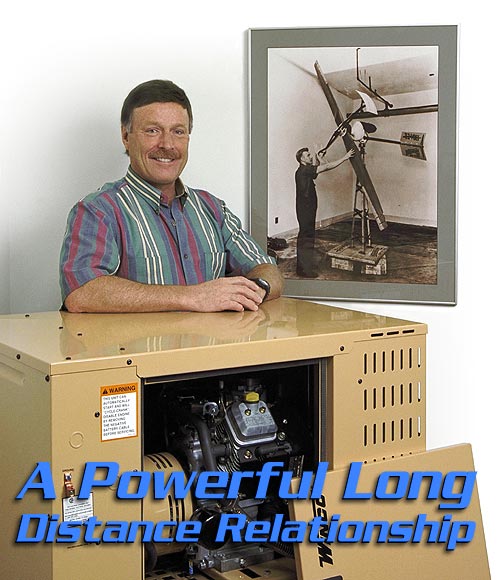

Ralph Call, 55, runs all his southern Minnesota business ventures out of his comfy home, snug up against the snow-capped Rockies in scenic Providence, Utah. He stays connected to Minnesota via a computer, fax, telephone and a 300 m.p.h. turbocharged Piper Malibu Mirage that flies back and forth monthly. It’s one heck of a commute.

His Utah holding company, Dyna Technology, Inc., owns Winco, a $30-something million generator manufacturer, Winpower, a smaller sister company under the same roof with Winco in Le Center, Minn., and Nevada-based Pioneer Builders Corporation, which manages, buys and sells real estate. And as of December 2000, it even had a 12 percent investment position in Mankato-based Winland Electronics. “We’re looking right now at getting Winland profitable and a couple of other business opportunities,” he says.

A self-described five-year man – “I have a philosophy that says I have to move every five years” – Call left Minnesota in 1999 for Utah to be nearer his 84-year-old mother and a slew of Wyoming childhood memories. When most business owners would have sold all their businesses before moving westward to nothing but “blue sky” country, Call was buying.

He certainly has left his mark on Le Center. Upon arriving in 1989, through Winco and later Winpower, he began impacting the city and its economy for the better: five years he was the managing president at Winco, five years a managing owner – and now he is an absentee fly-in owner in the first year of his most recent five-year plan.

He explains: “If I stay somewhere longer than five years I become a burden and whatever lift I gave to the organization initially is no longer there. I need to get out of the way to let somebody else grow. I believe that is true of politicians as well. I’m a big ‘term limits’ guy. I say get in, do what you have to do, and get out. Give another person a chance.”

The maze that brought Winco and Call together winds across eight decades and over much of America’s heartland: Wyoming, Kansas, Iowa, Nebraska, and Minnesota.

The Albers Brothers began Winco in 1927 to make battery chargers for radios. Their invention coupled a simple car generator to a propeller. By 1933 they moved their company to nearby Sioux City, Iowa, only to sell it a few years later to Zenith Radio. All sorts of products were built in Sioux City: wind chargers, inverters, power packs, generators, and radios. Production shifted during WWII to military products. The company won five Army-Navy “E” awards for its wartime efforts. At one point employment reached 2,000.

All went well until the 1950s when Zenith turned its focus towards television manufacturing. It sold Winco to a conglomerate, Amicor Corporation, and soon a downward death spiral began. Profits and sales faded. In 1977 a labor dispute in Sioux City prompted Amicor to relocate Winco to Le Center, Minn., but the change of scenery didn’t help. Winco continued losing money, so much so that Amicor started sending out feelers for potential buyers. Control Data Corp., the eventual buyer, “had more money than sense” at the time, says Call.

In the early ’80s Control Data Corp. thought alternative energy through “wind farms” would be the next big thing. Its master plan had Winco manufacturing wind generators. When federal alternative energy initiatives and subsidies ended, so did most of the alternative energy ventures. Winco’s regular engine-driven generator business – not its wind generators – kept its doors open long enough for Control Data Corp. to sell out to an investment group, the Zaidan Family of Montreal, Canada.

“The Zaidans were principally real estate people,” says Call, recalling the next turn in the Winco maze. The Zaidans owned Galtier Plaza in St. Paul, The Downtown Business Center and strip malls, condos and apartment projects in the U.S. and Canada. “They realized after a while that they didn’t know how to run a manufacturing company,” says Call. “The bank was about to foreclose, but before it did, it offered an ultimatum: either find professional management or face liquidation. So they hired me in October 1989 with a mandate to turn Winco around.”

Call, fresh out of college in the late ’60s with a B.S. in Manufacturing Engineering, began working for the Coleman Company in Wichita, Kansas. He later earned an M.B.A., moving into management to eventually become president of Coleman’s lantern and stove division. In the 1980s he was asked to head Coleman Powermate, a newly acquired company, based in Kearney, Nebraska. About a year after moving to Powermate his relationship with Coleman began to unravel.

“While I was in Kearney, in 1988, Mr. Coleman died,” Call explains, “and that activated his trusts. The beneficiaries of the trusts sold the company in 1989 to Ron Pearlman, a New York investor, who owns Revlon, Gilbraltar Savings, McAndrews and Forbes, and Sunbeam. He did own Max Factor, Marvel Comics and Technicolor. He’s a wheeler-dealer, not an operator.” After Pearlman bought Coleman, Call read the book “Predator’s Ball,” listened to what Pearlman and his minions had to say and decided it was time to change jobs.

He came to Winco as a managing president, not an owner. However, the deal he cut with the Zaidan Family had the potential to make him an owner. He agreed to cut his salary in half from its Coleman level if only the Zaidans would agree to award him five percent of profits and 50 shares of stock for each year specific targets for profit and sales were met. “The Zaidan Family thought the deal was great because Winco had never produced a profit,” says Call. “They didn’t think they were giving anything away.” Right from the beginning Call began hitting those targets and earning shares. “Management should always be accountable to the shareholders of a company,” he adds. “One of the best ways to motivate management and make them accountable is to pay a modest salary and allow them to increase that salary dramatically with strong performance. In almost every troubled company I’ve studied that formula is abused. Management is not held accountable and is paid for work they don’t do. This is always true when management dominates the board. The most important ingredient of a company’s makeup, if it’s going to be healthy, is to have an independent board.”

At first his attitude towards his newest five-year plan was that he would turn Winco around in a few years and then sell his shares. Winco had lost an average of $1 million a year for the ten years prior to his arrival. But after a while, he says, “it seemed obvious to me that it was a great company whose biggest problem was the ownership.”

The Zaidans sparred with each other constantly, with the children, two boys and a girl, jockeying for position around a dominant father. Call was caught in the crossfire. In an effort to end all the side distractions, Call and Henry Zaidan, one of the two boys, bought out the rest of the Zaidan Family in 1994, with Call owning 49 percent of Winco and Zaidan 51. Call became the day-to-day manager and Zaidan continued nursing his other business activities. The new arrangement only lessened the number of disagreements; it didn’t stop them. Call wanted to reinvest profits into improved facilities and new machinery. His ideas didn’t click with Zaidan’s, who preferred faster growth using a higher level of leverage.

“Finally, in 1996, I thought the best thing was for one of us to continue and for the other to find something else to do,” says Call. “I took an offer to Henry and gave him the option of owning or selling. He thought about it for a week before deciding to sell. I’ve been the owner since. I believe that if you’re going to divide the pie, like we did, to be fair, you should let the other guy choose his piece. I would have been satisfied either way.” The two have remained good friends.

Winco, and its smaller sister company, Winpower, purchased in 1997 and moved to Le Center from Indiana, builds engine-driven generators ranging from three kW models all the way to 500 kW Winpower units that could “power half the city of Le Center.” The wind generators from its Control Data Corp. past now are only colorful memories that fill picture frames in Call’s Le Center office. Oil, which currently sells for about $35 a barrel, would have to double in price for most alternative energy sources, such as wind, to become viable.

Limping Through The Y2k Backlash

Even though Winco and Winpower finished 1999 with more than $40 million in sales and 180 employees, 2000 won’t be anywhere near those figures. When the sky didn’t fall going into 2000 the world’s Chicken Littles cancelled $20 million in generator orders with Winco. But even after the big hit – “sales are down dramatically, and we’re at 100 employees now,” Call says – the future still seems bright. Sales in 2000 began rising to normal levels in September and the worst seems over.

He could have laid off his full-time people. “One philosophy I have is that if you are loyal to me, I’ll be loyal to you,” Call says, adding, “and I might even be loyal to you even if you aren’t loyal to me. We haven’t laid anyone off except part-time temporary employees since 1993.”

“We had been building towards a crescendo for about three years, beginning in 1997,” he continues. “Our business increased dramatically. We had been growing the business up to 15 percent annually since 1990. In 1997 we started 25 percent growth through the Year 2000 crisis nearly everyone thought we would have.”

In 1999, Winco and Winpower shipped only to order. All of 1999’s business was booked in 1998. The only people who booked in 1999 were people wanting to get in line for a 2000 crash. “I thought there would be a big snapback in business,” he says. “So instead of hiring people, we began sending our projects out to Jordan and Jackson to manufacturers who built generators for us. If we had hired new employees we would have had a commitment to them. With contract manufacturing we didn’t have that same commitment.”

Through November 2000 Winco and Winpower was rotating its full-time workers on a six weeks-on, three weeks-off paid schedule.

They sell to the rental industry, homeowners, business and farmers. One line appeals to new homeowners, particularly those with high-end homes, looking for backup power during power outages. Call has one such generator in his comfy Utah home, and says, “When my power goes out, the generator starts automatically. When the transfer switch senses an upstream voltage drop, it switches off the main line, starts the generator, and switches us onto the generator. By switching off the main line it protects the lineman sent out to fix the outage. Otherwise he could be electrocuted because power would be going out from the house and back to the line. The automatic transfer switch is a necessity if you’re going to have a standby generator.”

Winco has a significant market share, possibly 65 percent, in the power take-off generator market. “If you know a farmer with a generator, it’s a better than even chance that it’s a Winco or Winpower.”

Even though Call sees a recession rising on the horizon, he still seems optimistic. “We’re going to have a general slowdown in the economy next year, which will create some dislocations,” he says. “The stock market is unsettled. We’ve been a bit crazy and too speculative. Now we’re coming back to earth. But I still have confidence in America, its institutions and people.”

Fulfilling A Yearning For Public Service

“I have served as a director on the state chamber of commerce in Kansas, and as a director on the state chamber in Minnesota,” says Call. “The most precious thing that you have is your time. I feel a need to sacrifice time to civic duty. If we don’t defend our hard won freedoms, who will?”

In the mid-’90s, as a conservative, he won a seat on the Mankato school board after being endorsed by the Free Press. He had looked at running solely as a soapbox for certain issues, and wasn’t expecting to win the most votes.

“There are issues relating to the education of our children that simply cannot be addressed the way our system is structured,” he claims, narrowing his gaze. “The prevailing power in public education is the NEA, which looks after its own interest. To them the fact children need educating comes secondary. Of course, that isn’t the feeling of most teachers, who are dedicated and show concern for their students. But their voices often aren’t heard. Most school board members talk about classroom size, buildings and money for programs. Nobody talks about whether we are getting the job done. We have the Graduation Rule and Profile of Learning, and other foolishness from the state, which adds bureaucracy and cost and reduces the delivery of education to students rather than enhances it. I was an advocate for gifted and talented programs. In District 77 we spent a fortune on the bottom end and budgeted only $100,000 for the gifted and talented. Instead of having the principals identify gifted students, hire teachers and begin delivering curriculum, the school board consumed the money by hiring an expensive coordinator with an office and secretary. If they were farmers they’d eat their seed corn.”

Besides his one-term school board stint, he also served as the Bishop of the Mankato ward for the Church of Jesus Christ of Latter Day Saints, an 11-million member church based in Utah. He tries to mesh his business dealings with his personal and religious life. He says: “Religion has no value if it is only attendance at church or some nice things written in a book that no one has read. Religion is valuable when it provides you with a working moral code that guides you as you make your life decisions.”

© 2001 Connect Business Magazine. All Rights Reserved.