Bob Gallaway

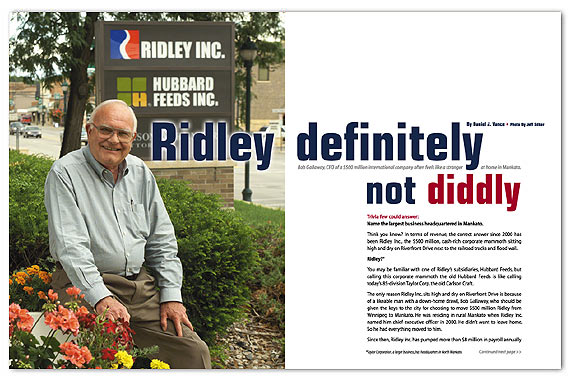

Bob Gallaway, CEO of a $500 million international company often feels like a stranger at home in Mankato.

Photo by Jeff Silker

Trivia few could answer:

Name the largest business headquartered in Mankato.

Think you know? In terms of revenue, the correct answer since 2000 has been Ridley Inc., the $500 million, cash-rich corporate mammoth sitting high and dry on Riverfront Drive next to the railroad tracks and flood wall.

Ridley?*

You may be familiar with one of Ridley’s subsidiaries, Hubbard Feeds, but calling this corporate mammoth the old Hubbard Feeds is like calling today’s 85-division Taylor Corp. the old Carlson Craft.

The only reason Ridley Inc. sits high and dry on Riverfront Drive is because of a likeable man with a down-home drawl, Bob Gallaway, who should be given the keys to the city for choosing to move $500 million Ridley from Winnipeg to Mankato. He was residing in rural Mankato when Ridley Inc. named him chief executive officer in 2000. He didn’t want to leave home. So he had everything moved to him.

Since then, Ridley Inc. has pumped more than $8 million in payroll annually into Greater Mankato. Their jobs pay on average $55,000. Ridley has brought in ten Ph.D. researchers. Other high-paid employees are arriving. This publicly traded corporation has been in aggressive growth mode, buying companies the way Pac-Man used to gobble up Ghost Monsters. All these acquisitions have meant growth for Greater Mankato.

Thank you, thank you, thank you Bob for moving Ridley Inc. to southern Minnesota. Go get the city keys, Mayor Kagermeier.

CONNECT: Of businesses headquartered in Mankato, yours is the largest. And yet you get almost no press—hardly anyone has heard of Ridley. Does that frustrate you?

GALLAWAY: Yes, it does. It frustrates me because Greater Mankato as a whole doesn’t recognize Ridley, and to a slightly lesser degree our subsidiary Hubbard Feeds. I’m not frustrated from a personal standpoint. But I am frustrated for our 150 Greater Mankato employees, because employees like to work for companies that are recognized by their neighbors as being progressive, sound, and good community citizens.

CONNECT: And as being the largest business headquartered in Mankato?

GALLAWAY: Right. But we don’t get that press attention.

CONNECT: And how difficult does that make recruiting potential executives?

GALLAWAY: Our executive recruiting efforts begin with a large help wanted ad in the local newspaper bearing the heading “Ridley Inc./Hubbard Feeds.” We also run ads in the Minneapolis and Rochester papers. Many of the people from Mankato who call and email have no idea who we are or what we do.

CONNECT: What do you say to people who think you’re just the old Hubbard Feeds with a new name?

GALLAWAY: (Laughter.) I get that all the time. People ask, ‘What do you do?’ I usually respond by simply saying, ‘I work for Hubbard.’ They say, ‘Oh, you mean out on Third Avenue.’ Then I explain that our local plant is on Third Avenue. I’ll say, ‘No, I’m in the office on Riverfront Drive.’ They’ll shoot back, ‘Where’s that office?’

By that time in the conversation it’s obvious they don’t know anything about the $500 million Ridley Inc. based in Mankato. I usually have to tell them the feed plant in Mankato is only one of almost 50 we own in North America.

I have also come across people who still think the Confers own Hubbard Milling. The other day on KTOE a person being interviewed was claiming the Confers still own and manage it. But the Confers haven’t been here since May 21, 1997.

So I tell people we’re not the old Hubbard Milling, but that we’re the new Hubbard Feeds and Ridley is the parent company. Both Hubbard Feeds and its corporate parent Ridley are based in Mankato. I say we’re a major player in the U.S. feed business with almost 50 plants and 1,500 employees. Our annual revenues are $500 million.

CONNECT: Who chose Mankato as the world headquarters for Ridley Inc. and why?

GALLAWAY: Me. (Laughter.) And because I live here. (Laughter.) When Ridley acquired Hubbard Feeds in May 1997 I was in Mankato running its animal feed business. The Confers had hired me 18 months before to help them find a solution for their feed business. It was a traditional feed business in a rapidly changing market. The end result: the Confers decided to sell.

When Ridley purchased Hubbard Feeds I was made Vice President and General Manager of U.S. Feed Operations, which was basically Hubbard Feeds. Then we bought Zip Feed Mills and consolidated that into Hubbard, and made other acquisitions. In spring 2000 we acquired Wayne Feeds.

Ridley Inc. is affiliated with Ridley Corp., an Australian company. In late 1999 they gave me the responsibility for its U.S. and Australian feed businesses. In early 2000 I was named Ridley Inc.’s chief executive officer. At the same time they named Mike Mitchell, who was based in Mankato, as chief financial officer.

CONNECT: Where was Ridley Inc. before you moved its headquarters to Mankato?

GALLAWAY: Downtown Winnipeg, Manitoba. The board said that if I wanted to relocate company headquarters I could. It was my decision. Therefore, the accounting functions were moved, which meant hiring a controller, staff accountants, a business development manager and others.

CONNECT: Could you go into greater detail on the scope of your business?

GALLAWAY: In North America we have about 50 feed manufacturing plants of one kind or another.

The part of our business southern Minnesota is most familiar with is animal feed. We manufacture feed products for about every species. That part of our business we call Ridley Feed Operations, and it operates throughout U.S. and Canada, manufacturing pre-mixes, starter feeds, supplements, and in some cases complete diets for animals. In that part of our business we have two kinds of customers: the traditional livestock farmer and our commercial customers. The commercial customers are the ones with several thousand sows and more. The largest controls 100,000 sows. In the dairy side our business is moving rapidly to service larger commercial dairies, such as one customer with about 8,000 cows. Our commercial customer base is fast-growing.

Those larger customers are served as market segments of “one.” We work closely with each on a technical and business relationship to develop products and programs to fit their particular needs.

CONNECT: Can you give an example?

GALLAWAY: Take a large hog producer: 10,000 sows produce about 200,000 pigs a year. Most of these animals are sold on marketing agreements. For example, we have one customer who sells to a “value-added” packer. In the grocery store you may see his product that ends up as “marinated pork tenderloins” under a variety of brand names. And next to it you’ll see “processed meat.” The packer buying hogs to produce the marinated pork tenderloins wants every hog to be identical: same length, weight, and cut.

We develop programs for the farmer producing hogs going into the tenderloin, so that every time his hogs walk off the truck at the packing plant they are exactly the same size and age, and the back fat is exactly the same. To do that, we help farmers put genetics, management and nutrition together.

Now revisit the traditional farmer selling hogs going into processed meat. He doesn’t have to raise hogs the same way as the “marinated pork tenderloin” farmer. For him identical length and weight aren’t important. To the “processed meat” farmer we sell a prepackaged set of products—but to others, like the marinated pork tenderloin farmer, it’s a market segment of one.

CONNECT: Now back to the scope of your operation.

GALLAWAY: Besides animal feed, other divisions of Ridley Inc. are Ridley Block Operations, Cotswold Swine Genetics, and McCauley Bros., based in Kentucky, which is involved in equine nutrition. We employ nearly 30 Ph.D. researchers in North America and they are involved in everything from product development to advising customers. About ten are based in Mankato.

As for animal feed and our market share in that, in terms of total tons of product produced throughout North America, as a company we rank fifth or sixth.

But we don’t manufacture much complete feed. Most of what we make a farmer buys to combine with corn, soybean meal or wheat to make finished feed. About 120 million tons of commercial feed are fed annually in the United States. About half of that is fed by large integrators, a market we’re not in. The other half, about 60 millions tons, basically is our customer base. Of that 60 million, if you take our pre-mixes, base mixes and supplements, and mix them out into complete feed, our feed would be involved in about 12 million tons of feed annually.

For example, we have a dominant position in the egg-laying business in the U.S., feeding 20 percent of the national flock. But we feed that flock with a two-pound pre-mix. The egg producer buys our two pounds containing micronutrients—the trace minerals, vitamins, synthetic amino acids—and mixes that two pounds with a ton of corn and soybean meal. So our two pounds have a complete-feed equivalent of one ton.

CONNECT: Your biggest competitors?

GALLAWAY: In terms of raw volume, Land O’ Lakes and Cargill, and after them we’re all about equal. Our major competitors are from two sources: major companies such as Land O’ Lakes, Cargill, and Archer Daniels Midland; and many one- and two-plant companies such as Big Gain, which has been very successful here in southern Minnesota.

CONNECT: You have hired, among others, a former HickoryTech executive to help you acquire new businesses. Your company has a strong cash flow. Does this mean some established high-tech ag-related businesses could be moving to Mankato in the next few years?

GALLAWAY: Absolutely. Currently we’re in the second year of a five-year business plan that calls for us to grow earnings by 50 percent. We’re in a very mature industry. Outside of acquisitions, there are only two ways we can grow—either through population growth or export. Our overall market grows only about two percent a year.

To grow 50 percent in five years we have to acquire other feed companies and consolidate them into our present operations, sometimes expanding our territory, product line or market access.

For example, we owned a feed plant in Saskatoon, Saskatchewan. Right across the street was another the same size. It was a sole proprietorship, and the owner wanted out. So we bought his business, shut down our plant, consolidated two into one, and made a much more efficient and profitable operation. That’s consolidation—synergies.

Another example: we manufacture horse feed. Until recently we hadn’t participated in the high-end, thoroughbred, breeder-horse feed business. I’d long thought a national brand could be established in the industry. Recently, we bought 51 percent of McCauley Bros. of Lexington, Kentucky. Now we have a second plant under construction. The acquisition gave us access to a new market. It’s easier to buy someone than to go in scratch.

CONNECT: Much easier.

GALLAWAY: And more predictable. So are we looking at other acquisitions? Sure. To stay up with our five-year plan—and I can’t give you the exact number—we need to invest in multiple, multiple millions on average per year in new business opportunities.

CONNECT: The Confers, who used to own Hubbard Milling, have an office in your Riverfront Drive building. Given your past relationship—you were hired by them—do they sometimes work for you as consultants?

GALLAWAY: They have offices here, and we see them daily, but there is no business connection.

The transaction went something like this: the Confers wanted to sell Hubbard Milling Company. They offered it for sale at auction where anyone could bid on the pet food side, the animal feed, or both. No one really wanted the whole business. There were companies that just wanted pet food, and companies that wanted just animal feed.

So Ridley and Windy Hill Pet Foods joined together. The fact Windy Hill was a U.S.-based company made for an easier transaction. We were incorporated in Winnipeg, Canada. Windy Hill Pet Foods did the actual stock purchase and simultaneously sold us the feed-related assets. Rick and Ogden’s involvement ended that day.

CONNECT: Are there any similarities in culture between where you grew up, southern Ohio, and southern Minnesota?

GALLAWAY: There are. Both are rural, friendly, and by and large inhabited by open and transparent people. There is one dissimilarity, though, and that’s the weather.

After having lived many years in Fort Wayne, Indiana, I didn’t like the winter. In Fort Wayne the skies cloud up in November and you don’t see the sun until April. Every winter day it gets to about 35 degrees, and every night 25. Winter there is cold, gray and wet. But we have come to like Minnesota’s winters and its bright-blue sky. Though it’s bitter cold at times, it’s fun. We enjoy living here.

CONNECT: I’ve heard you built a home overlooking a river?

GALLAWAY: On the Maple River, above where it joins the Le Sueur. It’s two miles southeast of Rapidan off a gravel road. We built there because I knew someday I’d retire. I don’t like golf, didn’t want two homes, and didn’t want to live in Florida or Arizona. We’ve made many friends here. I know I don’t want to move back to Fort Wayne.

CONNECT: Who owns Ridley?

GALLAWAY: Our shares are traded and listed on the Toronto Stock Exchange. If you want to own us you can buy shares. I buy Ridley Inc. shares through a Mankato stockbroker. The price is in Canadian dollars, which I pay for in U.S. dollars.

We have major mutual funds that own significant percentages. We also have an “ultimate parent,” Ridley Corporation Limited, an Australian company with feed and salt businesses in Australia. It owns 70 percent of our shares.

CONNECT: Why Toronto and not NASDAQ?

GALLAWAY: When the “Australian” Ridley first came to North America, they came to Canada. Both Canada and Australia are in the British Commonwealth. The first listing was done in Canada. And the headquarters until recently was in Winnipeg.

CONNECT: In what ways do PRRS, Foot and Mouth, West Nile Virus, and mad cow disease affect your business?

GALLAWAY: Let me start with West Nile Virus. Though we’re in the horse feed business, it’s not much of an issue for us. That business, unlike our other businesses, isn’t commercial. We’re not producing food animals; they’re pets. West Nile Virus is an issue, but it’s not like PRRS, Foot and Mouth and mad cow—diseases that can create economic havoc.

PRRS, Foot and Mouth and mad cow disease have the potential to impact us. To give an example: recently mad cow infected one cow in Canada. Once it was discovered, the borders closed. The Canadians couldn’t export meat to the U.S.—this was a big blow to Canada because it exports 60 percent of its beef production. Now they can’t export anywhere. You talk about creating economic havoc—and all from one cow.

This is a serious issue, but let’s put it in perspective. More than 40,000 Americans are killed each year from automobile accidents. In the last 20 years 137 people have died from mad cow disease. The 137 deaths weren’t justified. But news organizations have been good at raising that fear to an hysteria.

CONNECT: So how does mad cow disease affect your business?

GALLAWAY: Our affected customers can’t pay their bills when they aren’t making money. Foot and Mouth disease has a similar impact. Everything must be quarantined. This is the reason why we sold our swine business in Europe. Foot and Mouth disease just destroyed the British and German pig market. In time it became evident that some companies had to leave. Either we had to be a consolidator or a consolidatee, and I didn’t want to be a consolidator.

CONNECT: Because that would have increased your risk in Europe.

GALLAWAY: Yes. So I sold our operations there to a European company, one willing to take the risk.

CONNECT: What about PRRS?

GALLAWAY: It’s a different issue. PRRS is unique to pigs. There are only two kinds of swine operations in North America: those that have PRRS, and those that will have PRRS. PRRS is porcine respiratory and reproductive syndrome. The sows abort their litters, and the pigs that don’t abort have higher morbidity. Will the industry one day get its arms wrapped around PRRS? Sure it will. How long will that take? I don’t know.

CONNECT: I’ve seen some people wrinkle their nose when they learn a new business in southern Minnesota is ag-related, as if being that means it’s second-class. What’s your response?

GALLAWAY: There are people who look at agriculture as a second-class industry, particularly those who are uninformed and with strong feelings about the environment and animal welfare.

To counter all the misinformation, we support good education programs. We are good stewards of the land. We do produce pigs using intensive production systems, but what we do is much better than letting them slop around in mud puddles—the way of 40 years ago. We do use intensive dairy production systems to produce milk, and we cool them in summer and heat them in winter. But that’s much better than letting them walk through the pasture mud and drag their udders over the barn door sill—the way of recent history.

CONNECT: What happens when Bob Gallaway retires? Could the next chief executive officer move the headquarters back to Downtown Winnipeg?

GALLAWAY: I don’t see that happening. We are a rural business, and have hired people who like rural Greater Mankato. We have a corporate staff here of almost 100. I’m rural at heart. I don’t want Downtown Winnipeg or Minneapolis. If we tried to move there, we would have a great number of people who would not follow. Mankato is where we belong. I can be at the airport in an hour and fifteen minutes. If I lived north of Minneapolis, it would take an hour. So what’s the difference?

*Taylor Corporation, a larger business, has headquarters in North Mankato.

No man is an island

Bob Frost

– Executive Vice President, Ridley Inc.

– General Manager, Ridley Block Operations

Bruce Johnson, PhD

– Vice President, Research and Nutrition Services, Ridley Inc.

Cal Martin

– Vice President, Ridley Inc.

– Chief Operating Officer, Ridley Feed Operations

Dennis Longmire, PhD

– President & CEO, McCauley Bros. Inc.

Eddie Wells

– Vice President, Ridley Feed Operations

– Assistant COO, Ridley Feed Operations

Gordon Hildebrand

– Director of Finance and Administration, Ridley Inc.

John Richardson

– Corporate Secretary, Ridley, Inc.

Mike Mitchell

– Chief Financial Officer, Ridley Inc.

Steve VanRoekel

– Vice President, Ridley Inc.

– President, Ridley Feed Operations

Get to know: Robert “Bob” Gallaway

Born: August 11, 1939, in Van Wert, Ohio.

Education: The Ohio State University, B.S. 1961, Agricultural Economics.

Personal: Wife, Jeanne; Children — Nan, Aaron, Erik.

Professional Associations: American Feed Industry Association (AFIA) Board of Directors and Executive Committee; American Feed Industry Insurance Company (AFIIC) Board of Directors; Valley CEOs.

© 2003 Connect Business Magazine. All Rights Reserved.