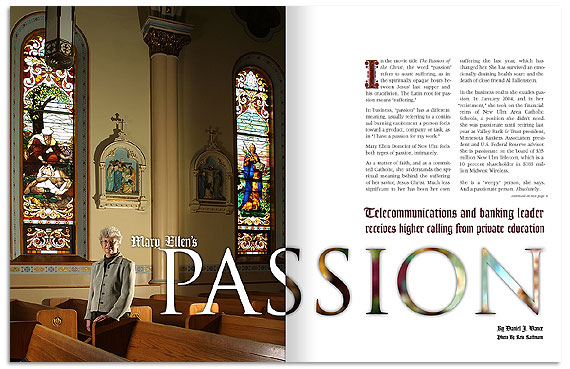

Mary Ellen Domeier

Telecommunications and banking leader receives higher calling from private education

Photos by Kris Kathmann

In the movie title The Passion of the Christ, the word “passion” refers to acute suffering, as in the spiritually opaque hours between Jesus’ last supper and his crucifixion. The Latin root for passion means “suffering.”

In business, “passion” has a different meaning, usually referring to a continual burning excitement a person feels toward a product, company or task, as in “I have a passion for my work.”

Mary Ellen Domeier of New Ulm feels both types of passion, intimately.

As a matter of faith, and as a committed Catholic, she understands the spiritual meaning behind the suffering of her savior, Jesus Christ. Much less significant to her has been her own suffering the last year, which has changed her. She has survived an emotionally draining health scare and the death of close friend Al Fallenstein.

In the business realm she exudes passion. In January 2004, and in her “retirement,” she took on the financial reins of New Ulm Area Catholic Schools, a position she didn’t need. She was passionate until retiring last year as Valley Bank & Trust president, Minnesota Bankers Association president and U.S. Federal Reserve advisor. She is passionate on the board of $35 million New Ulm Telecom, which is a 10 percent shareholder in $185 million Midwest Wireless.

She is a “weepy” person, she says. And a passionate person. Absolutely.

CONNECT: Take me through your career path.

DOMEIER: I was born and raised in New Ulm. After high school, my parents offered me a year of attending business or secretarial school tuition free, or a semester of the same at a private college. I opted for St. Benedict College. In December 1959, I became engaged and eighteen months later married. Then I paused to have a family and worked only part-time.

In 1965, still with young children at home, I became a part-time assistant manager at the New Ulm Chamber of Commerce. After my youngest entered school, I began working full-time at Sioux Trails Mental Health Center. After a year of that, I decided to pursue a business degree at Minnesota State University and almost simultaneously was offered a position at Valley Bank & Trust in New Ulm. I worked my way up through the ranks at the bank and became more involved in the community.

Finally, in 1985 I graduated summa cum laude from MSU and also completed graduate studies through the Prochnow School of Banking at Univ. of Wisconsin. By then I was a vice president and three years later was appointed bank president.

CONNECT: Why choose banking?

DOMEIER: If working the rest of my life, I wanted a career rather than a job. Mr. Palmer (of Valley Bank & Trust) in 1972 offered me a position because of his knowledge of my work at the Chamber and of my office management skills, thinking both would fit the bank’s needs. I took the position of executive secretary only with the assurance that if there were job openings I qualified for, that I would be considered. I made up my mind then to finish a business degree—and did it on the 13-year plan. (Laughter.)

CONNECT: You started as executive secretary in 1972. How long before your first promotion?

DOMEIER: Four years. I went from executive secretary to then being given the ability to write my own management training plan. Over a six-month period, in addition to my regular work load, I was allowed to move through the various areas of the bank. I worked with bookkeeping, operations, human resources, marketing, and customer service. I became familiar with the bank. After that, I became Assistant Cashier, which is another word for being the operations person, i.e., handling many of the accounting functions. At the time I didn’t realize the excellent education I was receiving. I was just having fun, enjoying each new challenge. (Laughter.) I never had any aspirations to one day run the bank.

The bank then was owned by State Bond and Mortgage Co. Mr. Palmer, bank president, and Roman Schmid, company CEO, seemed to have confidence in my capabilities, providing me with opportunities.

CONNECT: Tell me about your service on the Federal Reserve Consumer Advisory Council (CAC).

DOMEIER: The feeling I had after serving on it was the feeling you get after doing jury duty. You’ve done your civic duty. All CAC meetings are held in Washington DC. My task forces researched banking regulations, looking at them from consumer and industry perspectives. I was there with a mixed group, including advocates from consumer groups, representatives from megabanks, economists, and a few small banks. I served from 1999-2002.

CONNECT: You were advising the Federal Reserve. What did they do with your advice?

DOMEIER: We would meet two days at a time. The first day we analyzed information gleaned by researchers about specific laws. For instance, the information might be about “truth in lending.” After meeting and talking, we arrived at a recommendation. The next day we would have a formal meeting at the Federal Reserve with two or three Reserve governors to give them our recommendations. They would ask questions and we would discuss. The press was present, following your every word. The governors would then use our input to determine their direction.

CONNECT: So in other words, your group was an outside-the-Beltway reality check for the Federal Reserve?

DOMEIER: That’s a good way of putting it.

CONNECT: What about your Minnesota Bankers Association involvement?

DOMEIER: MBA is the largest state banking association, with over 400 banks as members. They provide a spectrum of educational services to bank employees, such as teller training or consumer lending. MBA lobbies the legislature and keeps members in touch with what is happening in St. Paul and Washington. It provides sound legal compliance advice to banks—sometimes small banks can’t afford the luxury of paying a full-time employee to stay current with new issues in documentation and disclosures. MBA provides invaluable training manuals and seminars.

My involvement started in 1997 as director before becoming treasurer and moving through the chairs. When I went off the board in July 2003 I was its chair, leaving them just as I was retiring from the bank. Serving there was a wonderful experience.

CONNECT: The MBA sent out a press release on July 6, 2001, saying, “Minnesota Bankers Association Headed by First Female President.” Did that headline bother you?

DOMEIER: I’m comfortable with it. I know some people may think I became president because I am a woman. I received throughout my tenure on the board nothing but respect. People responded to my ideas; its staff responded well. I felt I was able to contribute to some reorganization of it and some procedures they still use today. I didn’t take the press release negatively. It was a fact I was the first woman and certainly that was newsworthy. It was about time after 112 years.

CONNECT: Taylor Bancshares bought Valley Bank & Trust in 1992. Frandsen Financial purchased it in 1998. You worked under both. The differences?

DOMEIER: Frandsen Financial was larger, even though its 15 or so banks are generally small community banks, like Valley Bank & Trust. Frandsen today has a very strong core office system to give VB&T centralized technology, compliance, training, and accounting support. They bring a lot to the table so their banks can operate more efficiently.

CONNECT: What did you know of Al Fallenstein, the former Executive Vice President of Taylor Corporation who died along with his wife last December in an automobile accident?

DOMEIER: Al was one of these rare people. You know how when you run into someone with whom you graduated from high school, haven’t seen them in 15 years, and meeting them it seems as if you’d been in touch all along? Al was one of those people. Once we progressed beyond knowing each other through Taylor Bancshares and into that first few months of operation in 1992, the mutual respect we had for each other enabled our relationship to be one like that.

One phrase comes to mind when I think of conversations with him. “Well, Mary Ellen, you know what you ought to do…” He always had ideas, and they usually started with “we ought to.” I often wondered if he ever had to ask someone else for advice because he was always just so knowledgeable and forward-thinking.

I decided last September to resign from MSU’s School of Business Advisory Council. That was in line with my decision that year to downsize from volunteer commitments. And I copied Al on that resignation letter. He called me immediately, and learning then that I was going to retire from the bank, said, “That’s great.” He suggested that my husband and I “ought to” visit him and Erla in Florida in 2004. He was really excited about my retirement plans and he said I also “ought” to have a retirement party. He told me to include him in the party invite.

After his death, while driving to Mankato to the public service at Taylor Center honoring him, I couldn’t get a phrase from the song “Big Bad John” out of my head. One phrase of it applies to Al, where it says, “At the bottom of this mine lies a giant of a man: Big John.” He might have used a wheelchair, but he was a giant of a man.

CONNECT: And he never made it to your retirement party.

DOMEIER: No, he didn’t. (Pause.) No. That evening I was concerned about people coming because it was so horribly icy. I was just hoping and praying that folks wouldn’t take any driving risks. I figured there would be sparse attendance, primarily only New Ulm people. Then I saw some folks from Minneapolis and Mankato and missed Al, thinking all along they’d stayed home. There were a few people there who knew they’d died on the way, but who didn’t say anything for fear of taking away from the party. I didn’t learn until the next morning, reading it in the paper.

CONNECT: Have you met Dave Jennings, the businessman who ended up managing Minneapolis city schools?

DOMEIER: Yes I have. I can’t recall the circumstances, but it was during his stay in the Minnesota House, before he started at Schwan’s. When he took the job running Minneapolis schools, I hoped he would succeed. I could see on the horizon what was happening with education funding sources. Minneapolis was at least being creative by trying to run its school district in a new way. Its outsourcing of management for a school district was a novel idea, worthy of a trial run.

CONNECT: How did you end up running New Ulm Area Catholic Schools (NUACS)?

DOMEIER: I’d made the decision three years prior to 2003 that I’d be retiring then at 62. In that three-year period I was thinking of succession planning at the bank and of what I wanted to do with the rest of my life.

Last April, while my husband and I were visiting our daughter in Kentucky, I was relaxing one day, writing down my own strategic plan for retirement. As I finished parts of it, I bounced ideas off my husband because, really, it was our plan, not just mine. In that process, I narrowed down my volunteer commitments to just a few and one of those was New Ulm Area Catholic Schools. I knew I wanted to work in retirement, but wasn’t certain in what. Since I had proficiency in banking and strategic planning I thought I’d be doing some type of consulting work with banks for a few years before quitting everything.

Last spring, when Bill Moeller announced he would be resigning as superintendent of NUACS, a couple of weeks later the school board chair and Father John Richter stopped by my bank office. I thought they were there to ask for advice on strategizing for a replacement. But they asked me to be the Executive Officer of NUACS. They’d taken a hard look at the job description and for my benefit decided to move tasks involving curriculum and faith formation to other individuals. I would be doing only the business core of the job, which would include fund-raising and development. And I would be responsible for visioning and carrying the school forward over the next decade.

My initial reaction was to say no. I told them they needed an educator, not a business person with a business degree.

Then, and this may sound weird, but as they were talking I suddenly paused before responding to one of their questions. In my mind I could hear my mother’s voice, loud and clear, saying, “Mary Ellen, remember, always leave the party while you’re having a good time.” She used to say that while I was in high school, and that memory of her hit me hard. I had really enjoyed banking. But I began thinking that maybe it was time to let go of it, not to get into consulting. Maybe banking wasn’t what I should be doing in retirement. Maybe there really was a deeper calling with NUACS.

I told them I would pray about it and talk it over with my husband. Finally, I did decide to change careers and try running the business aspect of a school district. Maybe there is something I can contribute for a few years.

CONNECT: What do your schools offer that other schools don’t?

DOMEIER: We are so blessed in New Ulm to have excellent educational choices, something that people moving here comment on. What sets our Catholic schools apart is that our curricula revolves around faith formation. Our Catholic teachings very much permeate the daily life of our students.

CONNECT: Declining enrollment has to be one big challenge. How do you hurdle it?

DOMEIER: This is an issue much broader than just involving NUACS, one facing every school system in rural Minnesota. But the issue can be addressed.

All of us in rural Minnesota need to be involved in a community effort to encourage growth in general, to build our population. We need this not only to increase school enrollments, but to improve industrial and retail business prospects and to increase the tax base.

Here, we need to have good programs so people will consider NUACS. We need to be better at recruiting students. We also need to bring about efficiencies and cost savings until we begin having some success with growth in New Ulm. That growth could come from an industry already located here expanding or someone moving here bringing in 50 or a 100 jobs. All the school systems will benefit. Another solution is to grow our NUACS Foundation, which provides grants to help with scholarships, operating costs and keeping tuition down.

The first two months with NUACS I focused on the budget, fund-raising, and putting an investment policy in place to address our endowment dollars.

CONNECT: What skills did the school board see in you?

DOMEIER: Many people at NUACS had worked with me in some capacity or other and knew I have a skill set that includes organizational abilities and being able to look at the big picture.

CONNECT: Let’s shift gears. New Ulm Telecom is a bulletin board stock. Why not NASDAQ?

DOMEIER: The board agonized over that decision many meetings. When we looked at costs versus benefits, we decided not to change. We’re a small company without much volatile trading. We thought keeping it the way it was would be best for our shareholders. The route we use now in trading is ‘broker by appointment.’ It’s working for right now. That’s not to say that in the future this won’t change. We keep all options open.

CONNECT: Has the board ever talked of merging with HickoryTech or Hector Telephone? It would seem a logical move because you’re doing similar things.

DOMEIER: We keep all options open. Anything that looks like it might be beneficial to the company we consider. At this point, we have no intent to sell or merge. That isn’t to say the door isn’t open. Any director of any company that is looking out for the best interests of its shareholders has to keep all options open.

CONNECT: New Ulm Telecom owns about 10 percent of Midwest Wireless. Has that company’s success surprised you?

DOMEIER: Personally, I’ve been surprised it has grown so quickly, but not surprised at its success. When I came on the board in 1999 the deal with Midwest Wireless was already in place.

CONNECT: Hasn’t New Ulm Telecom increased its ownership percentage since 1999?

DOMEIER: Yes, we have. As for organizational structure, I look at Midwest Wireless almost as I would a co-op. When one member left last year, we exercised our ability to purchase its shares. What’s amazing about Midwest Wireless is to think it didn’t exist ten years ago. It has grown from serving just southern Minnesota to including parts of Iowa and Wisconsin.

CONNECT: Will New Ulm Telecom ever sell its interest in Midwest Wireless?

DOMEIER: We have no thoughts of selling our interest and are very satisfied with what is happening. Midwest Wireless will have challenges, though. Wireless technology changes quickly. Staying on top of technological change requires a huge financial investment. Buying the equipment is a huge investment, not to mention a huge risk. What if you purchase equipment and two years later it becomes obsolete? And the competition in wireless is tremendous.

CONNECT: What do you think of Dennis Miller, Midwest Wireless president?

DOMEIER: I served on the advisory council at MSU with Dennis. He’s a visionary, has the ability to do strategic and forward thinking, and can create excitement.

CONNECT: A business person told me once that Mary Ellen Domeier also could have been the president of a large corporation.

DOMEIER: Oh, how flattering that comment and how challenging that would have been. I don’t know if I would have enjoyed doing it. I’m from New Ulm. I love New Ulm. I love being involved in New Ulm Telecom because it’s a homegrown industry. I loved being with Valley Bank & Trust because of its local roots back to 1901. I have been more than content remaining in New Ulm.

CONNECT: When you were named bank president, attitudes were a bit different towards women in banking executive positions. Were you ever afraid you’d fail? Did that motivate you to succeed?

DOMEIER: I never feared failure. It never occurred to me. I really felt I was up to the challenge. The extra yoke a woman in management often carries though, particularly when she is rare in her industry, is that she feels she must work twice as hard as anyone to prove herself.

CONNECT: Why become so involved in Oak Hills Foundation?

DOMEIER: Oak Hills used to be called Highland Manor, a New Ulm nursing home. Its original facility was built in the ‘50s, which meant people working there had to use the lower level for laundry or kitchen services. It was a horribly obsolete facility for about 90 senior citizens. My grandmother was a resident.

Highland Manor’s board was trying to decide whether to build a new facility or remodel. Several people in the business community encouraged them to build new, which they did. The new facility became Oak Hills, resting on a campus near the medical center. Prior to its opening my mother developed cancer and was in the old Highland Manor in a hospice situation. She died a few days before the actual move to the new facility.

I feel close to Oak Hills. For one, I love old people. I love every wrinkle on their face and what the wrinkles represent in their lives. I love the stories they tell. I love being a part of anything to make their lives a little bit richer. That in itself is a reason why I want to be involved. Now Oak Hills has 16 market-rate, assisted living units in one facility and 16 subsidized-rate units, just completed. And it’s filling rapidly. The old Highland Manor building was sold to Martin Luther College and made into a dormitory. It worked out beautifully for everyone.

CONNECT: Your mother had cancer. Recently, you had a cancer scare. How did that change your outlook on life? or did it?

DOMEIER: This was last summer, while I was retiring from banking and just after I’d committed to NUACS. During a physical our family doctor discovered something suspicious. I started a series of tests and was held in limbo two months even though each doctor assured me “not to worry.”

The scare changed our lives in several ways. I began spending more time with children and grandchildren. I’m a weepy person, Daniel. The time I spent with them became much more precious. My husband and I took weekends with our kids and wondered how many more times we’d be able to do it. The scare also made us talk about the ‘what ifs.’ What if one of us had a stroke and was gone or disabled? The scare also confirmed my decision to retire from banking. But I wasn’t sure how having cancer would affect working with the school system.

In 1991, we moved into our dream home. It was everything we’d always wanted. It was a large house with a large yard. Last summer we decided to downsize from it while we were both in good health. Just a few weeks ago we moved into a much smaller place. We have done this to help the one of us that ends up alone. As it turned out, I didn’t have cancer. Now I have a whole lot more sensitivity towards others dealing with illnesses. And I think we decided well concerning our retirement plans.

CONNECT: It seems a recurring theme with you. You work with Catholic schools. You pray before making decisions. What role does your faith play in making daily decisions?

DOMEIER: Prayer with me is a daily and even minute-by-minute occurrence. I have a picture on my office wall of Jesus laughing. That’s my favorite picture and I have another just like it at home. I start my day with morning meditation, reading and prayer. Throughout the day, prayer is my resource and strength. The cancer scare reaffirmed my belief in the importance of faith and in having a spiritual foundation behind everything I do. Absolutely.

CONNECT: On to another topic: Why isn’t the land at US 14 and County Road 37 developed? It seems like prime property. The traffic count for retail there has to be fabulous.

DOMEIER: County Road 37 is still relatively new. As for being a main entrance into the city, it does have a few issues against it. There is a railroad crossing there and sometimes the train takes a while to pass. However, having said that, you are right, it is a prime piece of real estate there on the Nicollet County side. I served on the industrial site selection committee for New Ulm Economic Development Corp. some years back. We looked at many sites for an industrial park and what it would take to make each work. We also looked east near the site you mention. The site we chose was west of New Ulm, where a larger block of land was available. The site you mention would have entailed extending utilities under the Minnesota River, which floods. Of course, now some utilities run to Courtland, so developing that area could yet happen. The New Ulm side of CR 37 is developing quite nicely, including Microtel and Applebee’s recently.

CONNECT: Heritagefest: can it be saved? And if so, what needs to be done?

DOMEIER: I’m not worried about Heritagefest. They have a dynamic, forward-thinking board and a fantastic executive director. Poor weather has created the current situation. Heritagefest has come up with modifications that should help them through next year. The entertainment in years ahead will have a broader appeal. I’m not concerned. Heritagefest will survive.

On Al

If you wanted to seek counsel from someone, Al Fallenstein was the first person that came to my mind. He never made you feel as if you were infringing on his time, as if his time were too valuable. —Mary Ellen Domeier

Quick New Ulm Area Catholic Schools Facts

Students: 672

Schools: St. Anthony Elementary (pre-k-grade 4), Holy Trinity Middle School (grades 5-8), Cathedral High School (grades 9-12)

Teachers: 50

Principals: 2

Executive Officer: Mary Ellen Domeier

School Board Chair: Cindy Wendinger

Corporate Board President: Bishop John Nienstedt

Address: 515 North State

Getting Inside New Ulm Telecom

On January 1, 2003, New Ulm Telecom had 63 employees, 1,300 shareholders and owned 9.92 percent of Midwest Wireless. Including its share of Midwest Wireless revenues (estimated at $185 million in 2003), New Ulm Telecom operating revenues in fiscal 2002 were $30.1 million, with an estimate of $35-40 million for 2003.

The Company divisions:

New Ulm Telecom, the parent company, has 13,500 subscribers in New Ulm, Courtland, Klossner, Searles, Redwood Falls and parts of Brown, Nicollet and Blue Earth counties. It has cable TV systems in New Ulm, Courtland and Redwood Falls servicing 2,300 subscribers.

Western Telephone has 2,500 subscribers in Springfield, Sanborn and parts of Brown and Redwood counties. It has cable TV systems in Sanborn and Jeffers servicing 220 subscribers.

Peoples Telephone has 900 subscribers in Aurelia, Iowa, and parts of Cherokee and Buena Vista counties. It owns 12 percent of Fibercomm, which provides competitive local exchange service in Sioux City, Iowa. It owns 2.34 percent of Midwest Wireless.

New Ulm Phonery provides Internet services, telephone apparatus sales and service, toll and voice mail service in areas serviced by the above telephone companies.

Cell #9, which owns 7.58 percent of Midwest Wireless.

New Ulm Long Distance

Getting To Know You: Mary Ellen Domeier

Born: October 29, 1941.

Education: Cathedral High School, New Ulm. Minnesota State University, 1985. Prochnow Graduate School of Banking, 1985.

Family: Husband, Bob. Children, Philip, Anita, Joseph.

Association memberships: St. Mary’s Church: Trustee, Stewardship Committee, Eucharistic Minister; New Ulm Area Chamber of Commerce, ACH ya, too! (Activating Community Horizons Committee); Oak Hills Foundation Board; Rotary; Governor’s Judiciary Selection Commission.

© 2004 Connect Business Magazine. All Rights Reserved.

Pingback: Connect Business Magazine » Off-The-Cuff » Spring