Lakeshore Inn

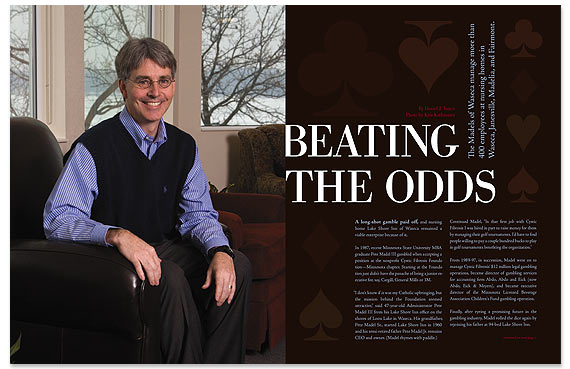

The Madels of Waseca manage more than 400 employees at nursing homes in Waseca, Janesville, Madelia, and Fairmont.

Photo by Kris Kathmann

A long-shot gamble paid off, and nursing home Lake Shore Inn of Waseca remained a viable enterprise because of it.

In 1987, recent Minnesota State University MBA graduate Pete Madel III gambled when accepting a position at the nonprofit Cystic Fibrosis Foundation—Minnesota chapter. Starting at the Foundation just didn’t have the panache of being a junior executive for, say, Cargill, General Mills or 3M.

“I don’t know if it was my Catholic upbringing, but the mission behind the Foundation seemed attractive,” said 47-year-old Administrator Pete Madel III from his Lake Shore Inn office on the shores of Loon Lake in Waseca. His grandfather, Pete Madel Sr., started Lake Shore Inn in 1960 and his semi-retired father Pete Madel Jr. remains CEO and owner. (Madel rhymes with paddle.)

Continued Madel, “In that first job with Cystic Fibrosis I was hired in part to raise money for them by managing their golf tournaments. I’d have to find people willing to pay a couple hundred bucks to play in golf tournaments benefiting the organization.”

From 1989-97, in succession, Madel went on to manage Cystic Fibrosis’ $12 million legal gambling operations, became director of gambling services for accounting firm Abdo, Abdo and Eick (now Abdo, Eick & Meyers), and became executive director of the Minnesota Licensed Beverage Association Children’s Fund gambling operation.

Finally, after eyeing a promising future in the gambling industry, Madel rolled the dice again by rejoining his father at 94-bed Lake Shore Inn.

Pete Madel Sr. had owned a few small-town hotels into the 1950s before selling and plowing some of the money into a Waseca nursing home start-up in 1960, Lake Shore Inn. He noticed many aging seniors needing places to live. “So my grandfather found this man to be his partner because he thought he had money, and the partner thought my grandfather had money,” said Madel III. “After the building was up and ready to go, they realized neither one of them had any money (for working capital). My father had read an article somewhere about ‘sales lease backs.’ So my grandfather and his partner eventually found some people from Minneapolis who agreed to purchase the building and lease it back to them. They then had money to operate it.”

That first year, amid the start-up confusion, Pete Madel III was born. Three years later his grandfather passed away and his father inherited administrative duties at the nursing home. Both Madel Jr. and Madel III had graduated from Waseca schools: the former from Sacred Heart High, the latter from Waseca High in 1979. Madel III, the subject of this article, enjoyed earning extra cash mowing neighborhood yards while growing up, and later, mowing the lawn and doing basic part-time plumbing and carpentry work for Lake Shore Inn. It all built up to Madel working full-time doing the same kinds of chores at Lake Shore Inn during the summer before his high school junior year. After earning Bachelors and Masters in Business Administration from Minnesota State University, in 1983 and 1987, respectively, he signed on with the Cystic Fibrosis Foundation—Minnesota chapter to run fund-raising golf tournaments.

“After a couple years of doing that, the Cystic Fibrosis gambling manager quit one day,” said Madel. The executive director promptly named Madel, who had an MBA, to fill the numbers-oriented slot. “When starting there, I didn’t know what a pull tab was. After becoming friends with the gambling manager, he told me their pull-tab operation had seven locations grossing anywhere from $800,000 to $1.5 million a month, and netting $1 million a year. We also did traditional fund-raising, such as golf tournaments, but those revenues were nothing compared to what gambling brought in.”

In 1991, Madel left Cystic Fibrosis for Mankato accounting firm Abdo, Abdo, and Eick, where he was named director of gambling services. Until that year, the State of Minnesota hadn’t required annual audits for nonprofits raising funds with pull-tabs. Jay Abdo saw a growth opportunity and hired Madel to start a new gambling division. For the most part, Madel had a sales job that included calling on familiar accounts in the gambling business, bringing in new accounts, and working on audits and consulting with various nonprofits.

In late 1993, the Minnesota Licensed Beverage Association (MLBA) hired Madel away to jumpstart its newly formed Children’s Fund charity. Again, Madel assumed the role of a salesman, cold-calling on high-traffic Minnesota bars in order to place MLBA pull-tabs. In four years, Madel helped grow the MLBA gambling business from a one-person operation grossing absolutely nothing to a 60-employee operation grossing $600,000 a month, and netting more than $400,000 a year.

Besides numbers and gambling, along the way Madel learned a great deal about people. “I had to get street smart really fast,” he said of selling for MLBA. “My wife grew up in the metro area and thought I was a small-town guy who didn’t understand the big city. One time, I took her into one of the bars that sold our pull-tabs. I thought it was a pretty tame place—in comparison to others I had called on. When we returned to the car, she said, ‘I can’t believe you took me in there. That’s the scariest place I’ve ever been in.’ I told her it had been a nice place.”

For example, Madel had called on Pearson’s Saloon located in Minneapolis’ notorious “Hell’s Half Acre.” Desiring to acquire more knowledge about the high-traffic bar’s operation, he asked a friend managing a nearby bowling alley his opinion. The friend’s response: Pearson’s wasn’t too bad—only had one murder the last five months. Besides being exposed to crime-ridden neighborhoods, Madel occasionally had drunken pull-tab players seriously threaten his life, saying the game was rigged.

Out of the blue, in 1997, Madel’s father telephoned, asking Madel to consider working for the family business again. The request had been a total surprise. “But by then I had been in the gambling business about ten years and was tired of walking into bars on the first of the month and seeing everyone with their welfare, social security and unemployment checks blowing them all on pull-tabs,” he said. He conferred with Wendy—they had married in 1993—and the two rightly judged Waseca as a much better place to raise children and work than Eden Prairie and North Minneapolis. A recent relaxing of federal government reimbursement policies allowed Madel Jr. enough financial wiggle room to hire his son as an assistant administrator.

At the time of his hiring, Madel didn’t realize the nursing home industry was in the midst of a massive sea change. Only two years before, in 1995, the federal government had begun tweaking rules concerning reimbursement that finally gave nursing homes financial incentives to cut costs. For instance, Lake Shore Inn, for years, didn’t have an incentive to refinance a 10.5 percent loan for a 1984 addition because the government was reimbursing every penny of their interest payment. Refinancing wouldn’t have put money in their pockets; it would have benefited only the state. When the new reimbursement rules came into being, Madel Jr. promptly refinanced to seven percent.

The new system required a radically new mindset. It was akin to the massive institutional restructuring affecting telephone companies after industry deregulation. All of a sudden, the industry needed administrators who were street-smart, able to think outside the box, and willing to take risks—to gamble. The former mindset, one of playing a wily game to beat a rattlebrained system, which Madel Jr. had mastered to perfection, no longer worked as well.

Yet when he had taken on the job, his dad and brother, an attorney, had called the nursing home business, “a real nice and stable with no ups and downs.” They told him he could pursue other business interests outside the nursing home. Given the new incentives, Madel III did make some changes that first year. To increase productivity, he brought in a number of computers—the organization had only two—and renegotiated vendor contracts. But he did nothing spectacular. In fall 1998, he earned his nursing home administrator license and officially started as the administrator.

That year, 1998, state and federal governments began pushing less expensive ways of caring for people. For example, the county started pre-screening patients to decide whether a nursing home was the most appropriate choice. Lake Shore Inn ended up with acute patients only. To reduce costs, the county started assigning some people who would have been nursing home residents in years past to assisted living facilities. Lake Shore Inn’s resident count slipped to about 85. The business, and the Madels, seemed destined for hitting a financial iceberg head-on. In short order, the nursing home industry had acquired stiff competition. The staffing model had to be restructured.

Madel said, “When first becoming the administrator, I remember saying to my dad that it was kind of silly every nursing home had its own administrator. There really wasn’t 40 hours of work to do. I thought I could run two or three nursing homes at one time.”

Around Thanksgiving 2000, a Lake Shore Inn registered nurse prodded Madel into applying for an administrator opening at the city-owned, 45-bed Janesville Nursing Home. Initially, the City of Janesville wouldn’t consider a part-time administrator; but when Madel took over interim duties and had to handle their director of nursing resigning and the hiring of her replacement—and did both well, his first month—the board had a change of heart. At the time, the nursing home industry had a shortage of licensed administrators. Janesville Nursing Home offered Madel a five-year contract. To manage costs for both facilities, Lake Shore Inn and Janesville Nursing Home began sharing professional staff, including a social worker and licensed therapists.

If not for having to extinguish a number of fires due to a falling resident count, Madel would have sought administration contracts with other nursing homes. For instance, his Lake Shore Inn count had fallen into the 70s before stabilizing at 65. In 2005, to counter the reduction, the Madels opened an adjoining 27-bed assisted living facility overlooking beautiful Loon Lake, Latham Place.

That same year, Madel’s new accountant, Larson Allen’s Dale Siegfried, learned that Madel had squeezed a six-figure net profit from Janesville Nursing Home while other nursing homes its size had nearly capsized. Siegfried asked Madel about the possibility of taking on administration contracts at other nursing homes. From that, Madel made detailed presentations to two in 2006 and eventually won the contract for Luther Memorial Home in Madelia, a facility owned by a dozen churches. With his father and nephew assisting part-time, Madel and his Janesville director of nursing, Kelly Breck, helped reduce Madelia staffing in a creative way that didn’t hurt patient care. Madelia had lost a substantial sum over the previous two years and Madel would whittle that into a positive cash flow by year’s end 2007.

Said Madel, “In Madelia, the employees all said I couldn’t do what I said I was going to do. Our director of nursing from Janesville was a big help winning over the people there. We’re off to a banner year this year (2008).”

At about the time Siegfried pointed Madel toward Madelia, the Madels had lunch with ISJ-Mayo’s CEO Dr. William Rupp, whose mother for years had been a Lake Shore Inn resident. The Madels were seeking timely advice on how their nursing home could work better with hospitals and how to position their nursing home for the future. The cordial meeting began a yearlong dialog in which Lake Shore Inn and ISJ-Mayo discussed a possible joint venture involving ventilator dependent patients. Though ISJ-Mayo chose a different path, the relationship with Rupp paid off. Rupp told the Madels of a nursing home in Fairmont possibly needing a new administrator.

The Fairmont hospital administrator had recently retired. He also had been a licensed nursing home administrator managing the Fairmont Medical Center Lutz Wing, a nursing home. The new hospital administrator didn’t possess the appropriate nursing home administrator license, and a fill-in administrator working at Mayo facilities in Wells and Albert Lea had been pressing to work all three locations.

“So Fairmont called me,” said Madel. “Steve Prybl knew we’d been working with Madelia and Janesville and had been successful turning around those operations. Fairmont was a perfect fit for us because Madelia was only 25 miles away and we could combine some operations. We had 70 beds in Madelia and 40 in Fairmont. I went to Dawn Campbell, our Madelia administrator, and asked her if she wanted to be farmed out one day a week to Fairmont. Her running down there saves the Madelia hospital money because they don’t have to pay for her that day. We started managing the Lutz wing in July 2007.”

Currently, Pete Madel Jr. owns Lake Shore Inn and Latham Place, its assisted living facility, while son Pete has long-term consulting contracts with nursing homes in Janesville, Madelia, and Fairmont. His consulting business oversees about 400 nursing home employees, and his contracts involve three vastly different ownership groups: the City of Janesville, a Lutheran church consortium, and Mayo Health System. Madel III said that nursing homes can survive under the present funding system, but many administrators resistant to change won’t. It just takes an administrator occasionally willing to gamble.

As for the mentality necessary to manage a modern-day nursing home, Madel—looking around his barebones-to-the-extreme administrator’s office—replied, “When I started with the Minnesota Licensed Beverage Association Children’s Fund in 1993, we had only a couple thousand bucks in the bank. I was making cold calls. I had to watch every penny and had tight financial controls. As for my office now, it isn’t fancy. My first office with MLBA was about as big as my current closet, just big enough for a desk and chair.”

Pull Tab Fever

“You’ve been in bars with pull-tabs, haven’t you?” asked Madel to the writer. “For the bar to have pull-tabs, a charity must sponsor the pull-tabs and run the operation. There are 3,000 tickets in a pull-tab game. Back when I was involved, a game would cost $45 to buy plus tax, which would mean a game would cost the charity $250 to put it into play. If you have $3,000 in gross earnings and you pay out 80 percent in winnings, that leaves the charity with a $600 potential profit, minus the $250. So if you sell every ticket your charity can make $350 on that 3,000-ticket game.”

The State of Minnesota ordained the current gambling system in the mid-‘80s, said Madel. Some smaller charities have as a customer only one bar that sells just a few tickets nightly. The Multiple Sclerosis Society, the largest charity raising money through pull-tabs, has hundreds of smaller bars and probably grosses millions monthly. Madel’s strategy with the Minnesota Licensed Beverage Association’s Children’s Fund was to seek out a handful of busier bars having great potential.

With MLBA, Madel eventually supervised sixty employees. “And we brought in all this money for the MLBA Children’s Fund,” he said. “Every month nonprofit groups would write us letters asking for donations. IRS and Minnesota law said we had to give a good portion of the gambling money away. So during our monthly board meetings we reviewed grant requests and dispersed funds. American Legions and VFWs—they all have gambling operations. They act as a broker, in a way, raising money through gambling and giving it away.”

Purse Strings

“There are two primary ways we get paid. One is through Medicaid, a state program, and the other Medicare, a federal program. Besides Medicaid, the State of Minnesota also sets all our rates for private pay residents, one of only two states doing it. In other states, the nursing homes set the rates on private pay. Medicare has been a good payer source for us since 1997, when the Clinton Administration introduced the Perspective Payment System (PPS) to replace the former cost-basis system.

“I remember going to nursing home administrator meetings with Dad. Anytime you go to one you always hear doom and gloom—but those administrators have been saying that for 40 years and they are still in business. At the PPS meeting in 1997, I remember telling Dad I liked the new system and could make the numbers work; but to do it, we would have to bring therapy in house, instead of using an outside vendor. Where you can do well in this business is on the therapy side because the therapy reimbursement rates are good—if you are managing your costs well. We went that route and have done well.

“Nursing homes wanting to be successful now have to develop the Medicare business, have good outcomes for residents, and court area doctors to let them know what you’re doing.”—Pete Madel III.