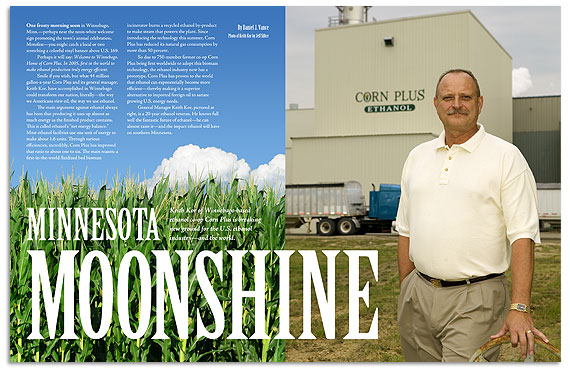

Keith Kor

Keith Kor of Winnebago-based ethanol co-op Corn Plus is breaking new ground for the U.S. ethanol industry—and the world.

Photo by Jeff Silker

One frosty morning soon in Winnebago, Minn.—perhaps near the blazing-white welcome sign promoting the town’s annual celebration, Motofest—you might catch a local or two stretching a colorful vinyl banner above U.S. 169.

Perhaps it will say: Welcome to Winnebago. Home of Corn Plus. In 2005, first in the world to make ethanol production truly energy efficient.

Smile if you wish, but what 44 million gallon-a-year Corn Plus and its general manager, Keith Kor, have accomplished in Winnebago could help transform our nation, literally—the way we Americans view oil, the way we use ethanol.

The main argument against ethanol always has been that producing it uses up almost as much energy as the finished product contains. This is called ethanol’s “net energy balance.” Most ethanol facilities use one unit of energy to make about 1.6 units. Through various efficiencies, incredibly, Corn Plus has improved that ratio to about one to six. The main reason: a first-in-the-world fluidized bed biomass incinerator burns a recycled ethanol by-product to make steam that powers the plant. Since introducing the technology this summer, Corn Plus has reduced its natural gas consumption by more than 50 percent.

So due to 750-member farmer co-op Corn Plus being first worldwide to adopt this biomass technology, the ethanol industry has a prototype. Corn Plus has proven to the world that ethanol can exponentially become more efficient—thereby making it a superior alternative to imported oil to satiate growing U.S. energy needs.

General Manager Keith Kor, pictured at left, is a 20-year ethanol veteran. He knows full well the fantastic future of ethanol—he can almost taste it—and the impact ethanol will have on southern Minnesota.

What’s your personal background?

I was born in Tracy, Minn., but grew up in Rochester, graduating in 1970 from Mayo High School. I spent three years in the Army before attending college. Later, in Wisconsin, I studied to be a radiological technician.

In 1982, a half-million gallon per year ethanol plant was scheduled to be built in Houston, Minn. That’s when I ran into Dale Morris at a restaurant near there and we began talking about ethanol. He said he was looking for someone to build his ethanol plant. I told him I had lots of relatives in the construction business and asked if I could put together a team to build the plant for him. He agreed. It happened just like that. It would be only the second ethanol plant built in Minnesota.

After the plant was built, Dale Morris asked me to work for him because he liked the way I handled myself—and he promised to train me. I stayed on with him three years until taking a position with a small, two-million-gallon plant, Elgin Alcohol, in Elgin, Iowa. In 1987, I went to work for Butler Research and Engineering in Minneapolis, who had a contract with Tropicana, which owned a sugar plantation in Duckinfield, Jamaica. They hired Butler to construct a dehydration plant in Kingston, Jamaica. So I went there. They would receive spent wines from Europe and ferment sugar cane to make ethanol. I was in Kingston for a year on Shell Oil property, training Shell Oil employees and helping them run the distillation system. In Jamaica they used benzine as an azeotrope to dehydrate the water out of the alcohol. The benzine breaks the azeotrope between the alcohol and the water. Today we use molecular sieves.

I went back to the U.S. to Hopkinton, Iowa, to work for Permeate Refining. They were located across the street from Swiss Valley’s largest cheddar cheese plant. We took their cheese whey and used it to make ethanol. Within a couple years Swiss Valley closed that facility and we used candy to make ethanol, such as marshmallows, gummy bears, root beer barrels, and peppermints. A lot of our candy came from Chicago—and we received “Willy Wonka” wash water after they washed out their vats. The wash water contained 20 percent sugar. In essence, they gave us the product to make ethanol.

I came to Corn Plus in March 1995 and was plant manager seven years before becoming general manager three years ago.

Iowa produces three times more ethanol than Minnesota. It has eight ethanol plants under construction or expanding—and currently produces 30 percent of the nation’s ethanol. Why is Iowa winning the race—rather than Minnesota—to become the energy capital of the future?

ADM owns many of those plants in Iowa. Their plant in Cedar Rapids is a big player in ethanol. They’ve been there a while. Most ethanol plants in Minnesota are in the 40-50 million gallon a year size. As for Minnesota, I don’t know why ADM hasn’t brought a large plant here.

Not long ago, two Martin County commissioners went on record as saying their county couldn’t support two proposed ethanol plants—one in Fairmont; another in Welcome. The first question: Is south-central Minnesota “maxing-out” in the number of ethanol plants its farmers can support? For instance, we already have plants in Winthrop, Lake Crystal, and Winnebago, and a major expansion is occurring across the border in Lakota, Iowa.

That’s true about the upgrade in Lakota. The larger companies building ethanol plants, basically, are taking a map and finding land that’s between two existing plants and at least 30 miles from both.

So Fairmont would be between Winnebago and where?

Going west, Bingham Lake near Windom. South of Fairmont the nearest would be Lakota. You also have an ethanol plant in Emmetsburg. Welcome would be a good spot for an ethanol plant.

If that plant goes in Fairmont—and it looks like it probably will—in my opinion, Martin County could not support another ethanol plant five miles away in Welcome. Again, in my opinion, a 100-million gallon plant will need anywhere from 38-40 million bushels of corn. Martin County alone produces only 37 million bushels of corn. Then you have the hog farmers consuming corn. How are they going to feel about that size of a plant going in Fairmont?

In my opinion, I think one 50-60 million gallon plant for Martin County would be ideal. I know the main argument for a 100-million gallon plant is that the economy of scale would make it most profitable. I understand that. But if you put a 100-million gallon plant in Martin County, Watonwan Farm Service will probably lose 30 percent of its business in Martin County and 20 jobs there because it would have no grain origination. That 100-million gallon ethanol plant would take all the grain. Yes, the new ethanol plant would create 40 new jobs, but that has to be balanced by the loss of 20. Your net gain is only 20. Corn Plus was looking at building a 50-million gallon plant, partnering with Watonwan Farm Service. With them involved we’d have a better net gain of jobs.

Corn Plus in Winnebago is a national leader in ethanol plant innovation—such as in developing by-products and its new power plant that burns biomass products. Do people in southern Minnesota truly realize what kind of a gem you have here?

Corn Plus has a very good reputation in the community and ethanol industry. You go to any ethanol trade show and bring up the name Corn Plus and you hear good things. We were one of the first dry milling plants in Minnesota. We’ve tried some different energy-savings technologies in the plant that have proven successful, such as heat transfers within the plant cutting our energy consumption 10 percent. Also, we set up our own yeast propagation system to reduce our yeast. The biggest energy saving measure we’ve adopted is our biomass fluid-bed technology. In the month of August, for instance, we were able because of the biomass technology to reduce our natural gas consumption by about 50 percent.

Your ethanol plant is the only one in the world with this technology?

Fluid bed technology has been around for quite some time. But we are the first in the ethanol industry to use it. Our technology has a patent. We feel that other ethanol plants will benefit from this technology. It has definitely reduced our natural gas consumption, and ultimately will erase the argument about the amount of energy used to produce ethanol versus the amount we put out. In a typical ethanol plant, the ratio is one unit of energy used for every 1.6 units produced. Our technology appears to be one unit in and six out. So we erase that old argument of ethanol production not being efficient. All of a sudden ethanol has a much more compelling argument.

We know this technology is catching on. We receive telephone calls asking about it, even ones recently from India and the Philippines. The gentleman from India said our technology is quite well known throughout the industry and world, and he feels it’s a very viable technology.

To reduce our energy costs, our biomass unit helping power our plant is burning an ethanol by-product, the syrup. In the past, we sold it as cattle feed. We also bring the emissions from our dryer into the fluid vent to use as a thermo-oxidizer, to meet pollution control requirements of the Pollution Control Agency. Many ethanol plants are putting in thermo-oxidizers, but they would require us to use up to 10 percent more natural gas. Here, we are reducing it by recycling it.

An argument could be made that yours is the most efficient ethanol plant in the world, with the biomass technology.

We are still collecting data. Hopefully by the middle of November we’ll have enough data to support that argument.

What are the by-products of making ethanol?

Years ago we sold land to Continental Carbonics, for them to construct a building. We send them our CO2, which they compress into a liquid in order to make dry ice and dry ice pellets. The latter is used for sandblasting, rather than sand. We sell our DDG, dried distilled grain. With the syrup on it, it was called DDGS, which stands for dried distilled grain solubles. Now that we have taken the syrup out of the equation—we burn that to make steam to power our facility—with the syrup off, the fat content of our feed has been reduced. But our feed looks a lot nicer now than when it had the syrup on it, when the increased heat from drying the syrup made the product look darker.

Are you making a corn de-icer?

No, not now. About seven years ago we were looking into using the syrup for that purpose. But now we have a much better use for it.

What about zein?

Zein is a form of starch—and by-product of corn—we looked at five years ago. But the process of getting the zein out—the technology wasn’t there yet, and it was an expensive investment.

What percentage of ethanol plants partner with another company to make use of their CO2?

About 60 percent. Our partner, Continental Carbonics, is from Decatur, Illinois. Their plant next to ours is a subsidiary, Dixie Carbonics.

The number of ethanol plants under construction nationwide is exponentially increasing. Yet only a handful of colleges train people to run them. Minnesota State University and South Central College were quick to jump on the bandwagon when wireless telephony began taking off. Why couldn’t they do the same with the energy of the future, ethanol?

There are only three community colleges involved in training: One in North Dakota, another in Iowa, and a third in Granite Falls, Minn. The last school is the school of choice right now because their program is set up specifically for ethanol production. With the new energy bill, you will see a lot more ethanol plants being built. There will definitely be a need for these types of college programs. Every graduate coming out of these schools right now is guaranteed a job. You will see more and more of these programs popping up all over the United States.

Given the extremely bright future of ethanol, why aren’t American oil producers buying into ethanol companies?

(Laughter.) Typically, in the past, oil companies thought “ethanol” was a bad word. They didn’t like it. When the ethanol industry continued growing, some oil companies began seeing ethanol as a viable alternative. Two years ago at our national ethanol conference, an oilman spoke. He said he felt like Daniel in the lion’s den. It was a first step. I think oil companies are finally realizing that ethanol is here to stay. Perhaps they may yet say, “If you can’t beat ‘em, join ‘em.” Even though they won’t want to do it perhaps, from an environmental standpoint one day they likely will buy into ethanol. You don’t see a big influx of oil companies building ethanol plants. But that could happen.

Have oil companies owned ethanol plants?

Ashland Oil had an ethanol plant in Kentucky in the 1980s.

Who are the end users for your ethanol?

One customer is Flint Hills, from Minneapolis, a subsidiary of Koch Refinery. BP is another customer—they have terminals in the Twin Cities. Some of our ethanol goes to Chicago and we even send some to Suncor in Canada. The end users are the oil companies, who mix our ethanol with their gasoline.

Corn Plus used to own 50 percent of Glacial Grain Spirits—and through it the production of Minnesota vodka. Why sell?

The vodka market is a tough one to enter. But more importantly, we felt our return on investment would be better spent on biomass technology. We entered that market because we are always looking at ways to diversify. At the time we also looked at corn oil extraction, de-germing, wind generation to supply power—many different projects. We believed the biomass technology gave us the best return.

The Environmental Protection Agency and the State of Minnesota reached a settlement a few years ago with 12 Minnesota ethanol producers. Your plant was one of them. What sort of changes did the EPA require?

In the past, when we did our emission testing, the state Pollution Control Agency (MPCA) primarily tested for particulate ethanol and methanol. Then Gopher State Ethanol of St. Paul ran into political problems with the City of St. Paul in regard to odor. The MPCA, because of political pressure, did further testing of Gopher State’s emissions and found other things coming from their dryer emissions. After having done that, MPCA felt that every ethanol plant in Minnesota was also in violation, even though we had passed our test, and were in compliance. We were guilty by association. So we entered some lengthy negotiations with the federal EPA, and MPCA, and arrived at a settlement. The EPA really liked our fluid bed (biomass) technology. It not only helps the environment, but it also conserves energy.

E-85 contains 15 percent gasoline and 85 percent ethanol. Why has its price been rising alongside 10 percent ethanol gasoline instead of staying low—considering the low, and steady, bushel price of corn?

Ethanol, typically, does follow the gasoline market. I’ve received a few calls regarding this. People want to know why E-85 is rising also. But pricing has more to do with retailers than us. We and 14 other ethanol plants use a marketing group called RPMG to market our ethanol in bulk. Some of our sales are based on contracts; the rest, on the spot market. If an oil company doesn’t want a contract, it will go on the spot market to buy ethanol. They receive the spot price for ethanol—not E-85, just straight ethanol—and blend it themselves. That E-85 price is whatever the retailer wants to charge. We don’t have control over retail pricing, except for our own little station out front our Winnebago facility. I try to keep that price about 40 cents below “10 percent” ethanol. I was in Alexandria two weeks ago, and there was a 40-cent difference there, too. I’ve heard the argument that some people won’t use E-85 unless a 30-cent spread exists because a car on E-85 gets less in gas mileage. I have an E-85 van, and I get only three miles to the gallon less. We currently sell E-85 at 80 cents below E10.

It’s on record now that Corn Plus has proposed building another ethanol plant in Welcome. It’s logical to assume that if you have been willing to build a new facility once, you would be willing to do it again somewhere else. If your stated desire to build in Welcome falls through, do you have other expansion plans?

The Welcome site is the one we desire most. If that doesn’t work, we’ll look someplace else. If we build there, we’ll look at the economics and make another decision perhaps somewhere else.

What about educating the public on ethanol and E-85? It seems misconceptions about ethanol still exist.

I’ve met people that didn’t even realize they were driving an E-85 compatible vehicle. That said, in general, the Minnesota Corn Growers is doing an excellent job educating the public. We donated $10,000 to help promote E-85, primarily in the Metro area and northern Minnesota. We need to educate the public more on E-85. Once we do that, I think we’ll see it take off.

I’ve seen statistics that say E-85 use can reduce gas mileage as much as 25 percent. Yet your personal vehicle loses only three miles to the gallon.

The amount of loss depends on your vehicle. You have to try it with your own vehicle to see how much the drop off is. We have a brochure that lists all the manufacturers making E-85 vehicles. The Larry Lung Association in Minneapolis has been a good ethanol advocate, a grassroots organization promoting ethanol as a clean burning fuel.

What do you say to people claiming that E-85 will wreck your engine?

I will say they likely have talked to an older mechanic, one who worked on cars in the 1980s. What happened then was that ethanol cleaned out gas lines and clogged up the fuel filters. Then their cars started chugging, and the first thing the mechanic said was, “Are you burning ethanol?” If you remember back in the ‘80s, gas stations often advertised that they didn’t have ethanol in their fuel. That was because many of the older vehicles weren’t equipped to deal with ethanol, and much of that was because of fuel filters.

What is the future of ethanol?

It’s very bright. Ethanol is here to stay. In the 1980s, the efficiencies and economies of scale in making ethanol didn’t exist. Now they do. Plants today are more energy efficient—and a lot larger than the ‘80s. A big plant back then produced ten million gallons a year. Now I’ve heard rumors of someone building a 200-million gallon a year plant. Today, a 50-million gallon plant is a smaller one.

The industry itself has matured. The Renewable Fuels Association has done a tremendous job of promoting ethanol and helping our legislators know its benefits. As for the future, we need to educate more people on E-85. We need to provide more technical education for the people who will manage and run the plants. The third aspect would be developing markets for our product—not only here in the Midwest, but also nationwide, especially the East Coast.

Could Congress mandate that all vehicles must be able to run on E-85?

When you start taking profit from oil companies—they aren’t going to like that. But we as a society need to consider a couple of different issues. One is our dependence on foreign oil. Will E-85 displace the need for oil? Not likely. Also, people need to fully understand the environmental benefits of burning ethanol.

What year must Minnesota cars begin running on 20 percent ethanol?

By 2010. Minnesota continues to take the U.S. lead with ethanol. We believe other states will follow ours, such as Iowa and Wisconsin. Oil companies don’t like to be told they have to blend ethanol. They don’t like to be mandated anything. So far Minnesota is the only state to require 20 percent.

Get To Know You

Keith Kor: General Manager, Corn Plus. Born in Tracy Minn., 9-22-52.

Personal: Married to wife Joan for 26 years; three sons, Joshua, Jacob, and Johannes.

Organizational Memberships: Renewable Fuels Association, American Coalition for Ethanol, Minnesota Coalition for Ethanol.

Corn Has Competition

Brazil is the largest producer of ethanol. They use sugar, as do many Caribbean countries. Some southern U.S. states use sorghum or milo. Plants in other states use wheat or barley. There is a big push now for cellulose for ethanol. Prairie grass, straw stubble, and wheat or bean stubble could be used for ethanol. For each ton of cellulose, you can make up to 70 gallons of ethanol. —Keith Kor, general manager, Corn Plus.

What They Do

The technology used at Corn Plus likely won’t be the only way to make U.S. ethanol plants more energy efficient. Dallas-based Panda Energy currently is constructing three 100-million-gallon per year ethanol plants—in Kansas, Colorado, and Texas—that will operate solely on biogas originating from cattle manure. These plants will require three billion pounds of cattle manure annually to operate. In a press release, the company claims the plants will reduce our need for imported oil by 300 million gallons a year.

Open Door, Incredible Growth

As of September 2005, Iowa and Minnesota accounted for about 40 percent of U.S. ethanol production. Southern Minnesota would seem an ideal location for a college that would offer a program to educate the thousands of ethanol plant workers and managers needed in the next few decades.

KEY: * farmer-owned / # under construction / & capacity when expansion completed / ADM ADM Owned – total U.S. capacity is 1070 million gallons.

(Capacity measured in millions of gallons per year.)

| Minnesota Company, City | Type | Capacity |

| Agra Resources Co-op, Albert Lea | * | 40 |

| Agri-Energy, LLC, Luverne | * | 21 |

| Al-Corn Clean Fuel, Claremont | * | 30 |

| Archer Daniels Midland, Marshall | ADM | — |

| Bushmills Ethanol, Inc., Atwater | * # | 40 |

| Central MN Ethanol Co-op, Little Falls | * | 20.5 |

| Chippewa Valley Ethanol Co ., Benson | * | 45 |

| Corn Plus, LLP, Winnebago | * | 44 |

| DENCO, LLC, Morris | * | 21.5 |

| Ethanol2000, LLP, Bingham Lake | * | 30 |

| Granite Falls Energy, LLC, Granite Falls | # | 45 |

| Heartland Corn Products, Winthrop | * | 36 |

| Land O’ Lakes, Melrose | * | 2.6 |

| Minnesota Energy, Buffalo Lake | * | 18 |

| Northstar Ethanol, LLC, Lake Crystal | 50 | |

| Pro-Corn, LLC, Preston | * | 40 |

| Iowa Company, City | Type | Capacity |

| Amaizing Energy, LLC, Denison | * # | 40 |

| Archer Daniels Midland, Cedar Rapids | ADM | — |

| Archer Daniels Midland, Clinton | ADM | — |

| Big River Resources, LLC, West Burlington | * | 40 |

| Cargill, Eddyville | 35 | |

| Corn, LP, Goldfield | * # | 50 |

| Frontier Ethanol, LLC, Gowrie | # | 60 |

| Golden Grain Energy, LLC, Mason City | * | 40 |

| Grain Processing Corp. , Muscatine | 20 | |

| Hawkeye Renewables, LLC, Iowa Falls | & | 95 |

| Hawkeye Renewables, LLC, Fairbank | & | 100 |

| Horizon Ethanol, LLC, Jewell | # | 60 |

| Iowa Ethanol, LLC, Hanlontown | * | 55 |

| Lincolnway Energy, LLC, Nevada | * # | 50 |

| Little Sioux Corn Processors, LP, Marcus | * | 49 |

| Midwest Grain Processors , Lakota | * & | 95 |

| Otter Creek Ethanol, LLC, Ashton | * | 55 |

| Permeate Refining, Hopkinton | 1.5 | |

| Pine Lake Corn Processors, LLC, Steamboat Rock | * | 20 |

| Quad-County Corn Processors, Galva | * | 23 |

| Siouxland Energy & Livestock Co-op, Sioux Center | * | 22 |

| Tall Corn Ethanol, LLC, Coon Rapids | * | 49 |

| US BioEnergy Corp., Albert City | # | 100 |

| VeraSun Fort Dodge, LLC, Ft. Dodge | # | 110 |

| Voyager Ethanol, LLC, Emmetsburg | * | 50 |

| Xethanol BioFuels, LLC, Blairstown | 5 |

© 2005 Connect Business Magazine. All Rights Reserved.