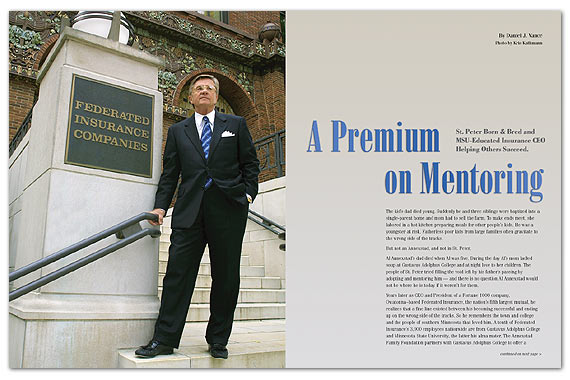

Al Annexstad

St. Peter Born & Bred and MSU-Educated Insurance CEO Helping Others Succeed.

Photo by Kris Kathmann

The kid’s dad died young. Suddenly he and three siblings were baptized into a single-parent home and mom had to sell the farm. To make ends meet, she labored in a hot kitchen preparing meals for other people’s kids. He was a youngster at risk. Fatherless poor kids from large families often gravitate to the wrong side of the tracks.

But not an Annexstad, and not in St. Peter.

Al Annexstad’s dad died when Al was five. During the day Al’s mom ladled soup at Gustavus Adolphus College and at night love to her children. The people of St. Peter tried filling the void left by his father’s passing by adopting and mentoring him — and there is no question Al Annexstad would not be where he is today if it weren’t for them.

Years later as CEO and President of a Fortune 1000 company, Owatonna–based Federated Insurance, the nation’s fifth largest mutual, he realizes that a fine line existed between his becoming successful and ending up on the wrong side of the tracks. So he remembers the town and college and the people of southern Minnesota that loved him. A tenth of Federated Insurance’s 3,000 employees nationwide are from Gustavus Adolphus College and Minnesota State University, the latter his alma mater. The Annexstad Family Foundation partners with Gustavus Adolphus College to offer a growing number of full-ride scholarships. Federated Insurance sponsors three MSU scholarships. And he has raised more than $2 million for Big Brothers Big Sisters in Minnesota.

Though he can’t repay everyone, he’s going to try. The rural kid with the tough upbringing is simply doing for others what was done for him.

CONNECT: Not many people stay with—or are able to stay with—the same company nearly 40 years. Were there times when you felt like quitting? Or when you thought Federated might let you go?

ANNEXSTAD: No. When I started the culture here was so good. I first became familiar with the leadership group when I was 23. They took a personal interest in me, my family and my career. I felt very good about being at Federated. So I have never looked back nor wanted to do anything else. The culture at Federated is such that many people come at a young age and work here for decades. Recently we had two people retire with more than 50 years active service. We have annual meetings of Quarter Century Clubs in Georgia and Minnesota where we recognize active and retired employees with more than 25 years of service.

CONNECT: How large is Federated? Where does it fit in the industry? What kind of insurance does it offer?

ANNEXSTAD: This year we will have $1.4 billion in premiums. Our surplus is nearly $1.2 billion. That gives us financial stability. We offer commercial insurance products that are recommended by over 320 trade associations throughout the U.S. Our clients usually are members of one of these associations. We’re the nation’s fifth largest mutual. We are rated A+ (Superior) by A.M. Best Company, the industry’s recognized rating analyst, and recognized as one of our nation’s top 50 insurers by the Ward Group, another industry watchdog. Of our 3,000 full-time employees, 1,700 are in Owatonna. We offer commercial property/casualty, health, disability, and life insurance to small- and medium-sized businesses. We help facilitate estate and business succession planning for business owners.

We’re a niche insurer, insuring only companies in certain industries. We were started a hundred years ago by the Minnesota Implement Dealers Association. Since then we’ve expanded into a dozen industries. Our presence is felt the most in the petroleum marketing industry where we insure about 6,000 oil marketers. No one else insures that many. They deliver gasoline and petroleum products to farms, homes and businesses, as well as operate convenience stores and service stations.

CONNECT: How did you expand nationwide?

ANNEXSTAD: We started writing property insurance some 100 years ago in Minnesota. The business expanded first into Georgia and Iowa, then Indiana, and from there we have become virtually a nationwide operation. Most of our expansion happened during the last 30 years; I was proud to play a key role in that expansion. We found that each state had petroleum marketers, like implement dealers, that needed an insurer who understood the specific risks of their business.

Although we have many larger clients, our customer base is made up mostly of five- to 100-employee businesses. Along with oil, we’re also a major player in the contractor market. In 1986, we decided we had to diversify. I was the new Director of Marketing then in charge of sales and marketing nationwide. We studied the contractor market, and felt there was a need for a company like ours. Today, that’s our second-largest market, with literally thousands of contractors insured. We’re recommended by the National Plumbing-Heating-Cooling Contractors Association, along with national trade groups in the equipment, oil, tire, convenience stores, and auto dealer industries.

CONNECT: You were named President and CEO in 1999. Were you surprised?

ANNEXSTAD: No. An important part of an organization like ours is marketing. We have 550 sales people. Sales and marketing is my background. In 1997, our then Chairman, Mr. C. I. Buxton II, who had spent his whole life here—he was of the third generation of the family that founded Federated—he asked me to run our operations. After much deliberation, I decided to do it, which meant I would oversee all the insurance marketing, claims and underwriting operations, whether property/casualty, health or life. So, in effect, I was already highly involved in the operation of the company as Director of Marketing when I became President and CEO. I was well prepared.

CONNECT: Many times in business a president leaves abruptly, and there is no one to mentor the next president.

ANNEXSTAD: It is so much better to be mentored before rather than after taking a position. One thing I did early in my career was to focus on the kind of people we hire. The better the people, the more dedicated and competent they become. We want people with knowledge, energy and passion, not only for us, but for our customers. Over the years we have “grown” these people, so our succession planning isn’t as difficult. I have 12 people on my leadership team, and most have been here more than 20 years. We don’t have to hire outsiders to recruit the next generation of leadership. It’s all here, and being developed and mentored as we speak. We have such a unique culture that it would make it almost impossible for someone outside to take over. My successor will come from within. I went to a Fortune 500 conference in New York months ago, and speakers there were advising not to bring people in from the outside, that is, people who don’t know the business, people or culture. They said an outsider’s chance of success is not as great.

It has been my objective for years to hire many people from MSU, Gustavus, and other Midwestern colleges. Usually they come from smaller communities, and are seeking opportunity. They are loyal. We have 250 employees from MSU. We have more employees from MSU than from any other college. We also have 50 Gustavus graduates. About one-tenth of our nationwide workforce is from MSU or Gustavus.

We also heavily recruit St. Thomas, Augustana, Bemidji, St. Cloud, St. Olaf, St. John’s, St.Thomas, and Winona State. This doesn’t mean we don’t hire people outside Minnesota. We have learned a lot from our connections with these schools. We are taking this recruiting rationale to major colleges across the country. We want the “best of the best” employee candidates from across the nation as well as Minnesota.

CONNECT: Why have insurance costs been rising?

ANNEXSTAD: Mainly because of litigation and soaring judgments. These expenses have simply gone out of sight.

Also, back in the late ‘80s and mid-’90s, insurance prices were falling. There came a point when premiums couldn’t cover losses. In the mid-’90s, prices the insurance industry charged were at least 20 percent below what it should have been to pay losses. Now the industry is catching up. This happens in our industry about every 10-15 years. It’s a recurring cycle in the property/casualty industry.

CONNECT: If you were in charge of tort reform, what would you do?

ANNEXSTAD: I would start by putting a reasonable limit on what could be paid out on injury losses. The court awards today are unrealistic. The bottom line is the consumer has to pay for these awards through their insurance premiums. Today claims of all kinds are being settled in the millions of dollars. Premiums have to pay those losses, and ultimately consumers have to pay the premiums. So there needs to be reasonable limits set.

CONNECT: Was Federated affected at all by 9-11? And how did it affect the industry?

ANNEXSTAD: 9-11—we were fortunate. We didn’t have much business in New York. We did have a death claim: a policyholder was on one of the planes. The industry was set back years. Many billions of dollars were lost. Those losses will affect us for a long time. Fortunately, we haven’t had another disaster, because the industry probably couldn’t handle one very well.

CONNECT: In your industry, where one insurance product is close to being as good as another, one of the few ways you can differentiate your company from another is your salespeople.

ANNEXSTAD: No question. You take away the ability of the salesperson and there isn’t much difference between many competing insurance companies. We hire the best of the best and give them the best training and leadership. We have 550 full-time salespeople. The other day I was mentioning to a group of managers that I’m from a small town. In a small town values like integrity and honesty are important. I said to them, ‘You know what? [Having small town values] is the kind of company we are.’ Then I asked, “How many of you grew up in a small town?’ Every person in that group of 20 had been raised in a small town, meaning a town of Mankato’s size or smaller.

CONNECT: Your mother, Alice, worked at Gustavus Adolphus College 40 years. Now you are on its Board of Trustees. Do you wish you could have attended Gustavus?

ANNEXSTAD: I would have loved to. However, I grew up in a family that didn’t have a lot of extra money for college. My one opportunity was to attend MSU. They offered a great education and it was the least expensive option. I could commute from home.

CONNECT: Your father died when you were five. Did he have life insurance for your mother?

ANNEXSTAD: Years later, my mother told me he had $5,000 worth. In 1946, that may have been called adequate. But I know it didn’t last us long. My mother had to care for four children. My father was a farmer near Norseland, west of St. Peter. Shortly after my father died, my mother sold the farm and we moved to St. Peter. Then she began work at Gustavus Adolphus in food service. She had to work. She was a wonderful lady, fantastic. Her number one objective in life was to raise four children.

CONNECT: What made her fantastic?

ANNEXSTAD: She sacrificed every day to make sure her children had both love and opportunities. She worked hard, and didn’t do much in life but work and spend time with family. We had a strong family unit.

CONNECT: How much of your success today can be attributed to going through those struggles?

ANNEXSTAD: Much of what has happened to me the last forty years can be traced back to my experiences growing up. I sold Christmas cards as a kid, trying to help make ends meet. And I’m proud of the fact I carried 106 Sunday newspapers around St. Peter when I was 10 or 12. I woke at five o’clock. Waking that early didn’t hurt me. It gave me work ethic. My success has a lot to do with how and where I grew up, and the kind of people I have been associated with—not only my family, but also the wonderful people of St. Peter. Those people adopted me, and helped me through those years.

CONNECT: One of those people was Bob Wettergren.

ANNEXSTAD: No question about it.

CONNECT: Is it coincidence that many of his employees went on to become successful in business?

ANNEXSTAD: He was a man who cared about his community. He loved St. Peter. He loved kids. We were fortunate he hired a few of us every summer to work in his dairy. I remember getting up at five in the morning and taking cans of milk to businesses around St. Peter. I am thankful there was a person like him who would give young people an opportunity to earn money.

CONNECT: Absent a father, and besides your mother, who were your mentors?

ANNEXSTAD: Many St. Peter business owners and families. Stan Davis (Davisco Foods) was a good mentor because I was a friend of his son Mark. They looked after me. Then there was Henry Komatz, who owned Komatz Construction. Henry was a prominent St. Peter businessman. He became a good friend, and was very concerned about my growing up. He gave me lots of opportunities to work for his construction company so I could afford college. One day Henry offered to pay my college tuition. I appreciated his offer, but told him I would feel better if I had to pay my own way. I told him that all I needed was a job in the summer and fall so I could attend college. Of all people, he was one of my greatest mentors.

My mom worked for Evelyn Young, who has since become an icon at Gustavus. Like it was for so many Gustavus students, her high spirit, work ethic and positive approach to life made Mrs. Young a role model around which, I believe, much of my character was molded. To this very day, I regularly seek out this 91-year-old grand lady for her good counsel and motivation. I am grateful she is such a big part of my life.

CONNECT: The Annexstad Family Foundation provides scholarships to underprivileged youth. You’ve also helped raise hundreds of thousands of dollars for Big Brothers Big Sisters. You fund the Al Annexstad Leadership Scholarship at MSU. Have you ever seen yourself when looking into the eyes of a disadvantaged youth?

ANNEXSTAD: I sure have. Life has been good to my wife and best friend, Cathy, as well as my family. Cathy and I take an interest in young people. We saw an opportunity years ago to help people mentored under Big Brothers Big Sisters. The Federated organization approached me about five years ago, wanting to do something special for Cathy and me in appreciation and recognition of my company anniversary. I told them they could help start the Annexstad Family Foundation, which gives underprivileged kids through Big Brothers Big Sisters a full-ride scholarship to a major college. Now we have six full-time scholarships in progress at Gustavus Adolphus, and we just announced our first scholarship to Notre Dame.

CONNECT: You studied education at MSU. Yet you didn’t become a teacher.

ANNEXSTAD: My goal as a young man was to attend college, get an education degree, and be a coach. I always wanted to coach in either high school or college. Then my senior year at MSU I was tapped on the shoulder by someone from Federated, while I was student teaching in Cleveland, Minn. If it hadn’t been for Federated, I may have been a teacher and coach, an honorable profession. However, being with Federated has given me an avenue to do many things: travel, work in Indiana and Georgia, meet people, learn about business, and relationships, and friendships.

CONNECT: What’s it like golfing with Arnold Palmer?

ANNEXSTAD: That was one of the most memorable opportunities I’ve ever had. A good friend told me one day that I would be playing golf the following week with Arnold Palmer. I thought he was kidding. We played eighteen holes. He’s the best thing going in golf. He’s a gentleman, a perfect citizen, and a great person. He and I have corresponded. Now he helps me raise money for Big Brothers Big Sisters. He signs pictures that we can auction for up to five thousand dollars.

CONNECT: How well did you golf?

ANNEXSTAD: I won a couple holes. He won the rest.

CONNECT: You’re a member of the Executive Committee of Minnesota Business Partnership. Has it ever lobbied for issues you oppose?

ANNEXSTAD: I don’t think I’ve disagreed with them. They keep their initiatives nice and simple, only three or four at a time. MBP is made up of many of the state’s top 100 CEOs, and they have a great interest in Minnesota’s future. I’ve been involved the last four years. I agree with their initiatives.

When I first became involved, they were talking about education. There is nothing more important than getting a good education. And, they talked about mentoring children—and nothing is more near and dear to my heart than mentoring. I understand totally that mentoring has to be a major initiative in this state. There are a lot of families that need the guidance of a caring adult. My primary objective is to try to be a force in helping kids in Minnesota.

CONNECT: Now to insurance: I would imagine loss prevention at the businesses you insure would be a major issue with your company. It’s one way to help lower the number of claims.

ANNEXSTAD: It’s a huge part. We have 150 loss control employees to assist and educate customers.

CONNECT: What’s a hot issue in prevention right now?

ANNEXSTAD: The huge challenge for businesses involves the people they hire to drive their company vehicles. Here is the question: Are employees truly qualified to drive company trucks and cars? We educate business owners on hiring and retaining qualified drivers.

CONNECT: What’s the industry’s biggest customer complaint?

ANNEXSTAD: The affordability of premiums. Over the last four year prices in property/casualty and health insurance have skyrocketed. Rising premiums have been a challenge for most small businesses.

CONNECT: Define a mutual?

ANNEXSTAD: A public company’s stakeholders are its stockholders. A mutual is owned by policyholders. We have no stockholders. Our stakeholders are also our customers. There are about 1,200 mutuals nationwide and 120 in Minnesota. Most of the ones in Minnesota are smaller, unlike Federated, which grew into a nationwide organization.

CONNECT: What is a hot issue in the industry as a whole?

ANNEXSTAD: There are many, including asbestos and mold claims. Highest on my list is tort reform. I do not believe the industry can control rising insurance costs without a major change in how we approach the frequency and magnitude of litigation. Tort reform is not just an issue for America’s insurance companies and businesses—it is an issue for our whole society.

CONNECT: What would your solution be?

ANNEXSTAD: It must be through reform and regulation. Reasonable caps must be placed on injury awards. Our economy eventually will be crippled without this sort of reform. With a cap, people may not have as much incentive to pursue some questionable cases, and that should limit the number of lawsuits. Recently I was at a meeting in Washington D.C. of the American Insurance Association, which is made up of top executives from the nation’s top insurance companies. Tort reform was the top issue.

CONNECT: What issue is most important in St. Paul?

ANNEXSTAD: In Minnesota it is workers’ compensation. Rates are going back up.

CONNECT: Why?

ANNEXSTAD: When rates go up it’s primarily because of losses. Insurers need money to pay losses. It’s as simple as that. Again, awards are being handed out that many consider unreasonable. Someone has to pay.

CONNECT: Tom Annexstad, General Manager of the Cambria operations in Atlanta is your son. What’s it like having him work for Mark Davis, the CEO of Davisco Foods International (owners of Cambria), who has been your lifelong friend?

ANNEXSTAD: Tom is enjoying working for the Davises. They are family friends, and we know them very well. The Davises know Tom’s values. He fits right in. Cathy and I are proud of our kids. My daughter Patti is a fiery competitor like her dad.

CONNECT: As for your employees, why have a 9:45 a.m. free coffee and doughnut break?

ANNEXSTAD: We have old-fashioned values. As management, we respect our employees. We are a family organization. So every day at 9:45, everyone gets a 15-minute coffee break to visit with friends.

CONNECT: How will Federated remember Al Annexstad?

ANNEXSTAD: Probably as one who had brought opportunity and business disciplines to Federated and led the company to national prominence. But I hope I’m remembered for the value I place on people. As we enter our hundredth year, I am sincerely proud of what Federated has become. But it wasn’t only because of Al Annexstad or others who served at the top. It was because of our 3,000 employees and the good people who came before them. For all these people I am appreciative.

© 2003 Connect Business Magazine. All Rights Reserved.

Pingback: Al Annexstad Federated Insurance | INSURANCE